Kawasaki Ltd. shows the following entries in its Equipment account for 2023. All amounts (in yen, in

Question:

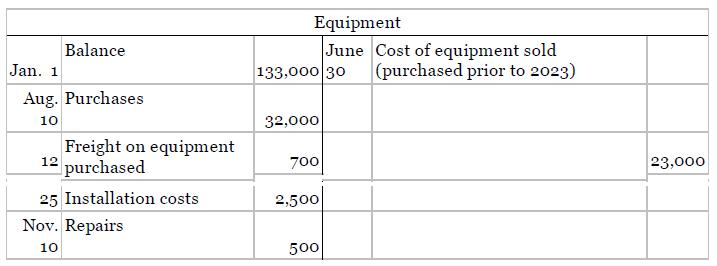

Kawasaki Ltd. shows the following entries in its Equipment account for 2023. All amounts (in yen, in thousands) are based on historical cost.

Instructions

a. Prepare any correcting entries necessary.

b. Assuming that depreciation is to be charged for a full year on the ending balance in the asset account, compute the proper depreciation charge for 2023 under each of the methods listed below.

Assume an estimated life of 10 years, with no residual value. The machinery included in the January 1, 2023, balance was purchased in 2021.

1. Straight-line.

2. Sum-of-the-years’-digits.

Equipment June Cost of equipment sold |(purchased prior to 2023) Balance Jan. 1 133,000 30 Aug. Purchases 10 32,000 Freight on equipment 12 purchased 700 23,000 25 Installation costs 2,500 Nov. Repairs 10 500

Step by Step Answer:

aPrepare Correcting journal entry Date Account title and explanation Debit Credit Repair ex...View the full answer

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Kawasaki Ltd. shows the following entries in its Equipment account for 2020. All amounts (in yen, in thousands) are based on historical cost. Instructions a. Prepare any correcting entries necessary....

-

Kawasaki Company shows the following entries in its Equipment account for 2013. All amounts are based on historical cost. Instructions(a) Prepare any correcting entries necessary.(b) Assuming that...

-

Suzuki Company shows the following entries in its Equipment account for 2015. All amounts are based on historical cost. Instructions (a) Prepare any correcting entries necessary. (b) Assuming that...

-

A metallic block (specific heat 500 J/kg K) of 100 kg mass having a temperature of 360 K is immersed in an insulated tank containing 40 kg of water at 300 K. Find the change in entropy of the...

-

A variable force of 5x-2 pounds moves an object along a straight line when it is x feet from the origin. Calculate the work done in moving the object from x= 1 ft to x = 10 ft.

-

The metal iridium has an FCC crystal structure. If the angle of diffraction for the (220) set of planes occurs at 69.22( (first-order reflection) when monochromatic x-radiation having a wavelength of...

-

If the business seems to pay too much attention to the technical aspects of IS projects, and not enough to the social and organisational aspects, why is that? What assumptions appear to have shaped...

-

A scatter plot can reveal a relationship between two indicators. Construct a scatter plot of annual data beginning in 1959 for inflation and money growth. Measure these as the percent change from a...

-

Question 1:- a) list down the advantages and disadvantages of NPV method. (4 each) b)Briefly write three factors that NPV technique takes into consideration in its analysis.

-

Manchester Technology, Inc. manufactures several different types of printed circuit boards: however, two at the boards account for the majority of the companys sales. The first of these boards, a...

-

Andrea Shen purchased a computer for 8,000 on July 1, 2022. She intends to depreciate it over 4 years using the double-declining-balance method. Residual value is 1,000. Compute depreciation for 2023.

-

Parnevik Group uses revaluation accounting for a class of equipment it uses in its golf club refurbishing business. The equipment was purchased on January 2, 2022, for 500,000; it has a 10-year...

-

(Basic journal entries, LO 3) Prepare the journal entries necessary to record the following transactions and economic events for Sahali Ltd. (Sahali): a. During 2005 Sahali had cash sales of $175,000...

-

1) What are the benefits of home-based working for the company and the employees? 2) What are the challenges in performance management in working from home? 3) What is the right mix of office-based...

-

This assignment is focused on project selection and the underlying factors used to make this determination. You will need to use the readings/videos, the previous learning modules, along with some...

-

1. While improper framing could affect the information we have on sark attacks, I think our decisions come down to "anchoring and adjustment". Because the information we received from the media was...

-

For each of the scenarios in the following table, indicate the most likely reason for the difference in earnings. Scenario Differences in Human Capital Compensating Differential Differences in...

-

All organizations whether it is the government, a private business or small businessman require planning. To turn their dreams of increase in sale, earning high profit and getting success in business...

-

Write a program that prompts the user to enter the month and year and displays the number of days in the month. For example, if the user entered month 2 and year 2012, the program should display that...

-

Which task is performed by a book-keeper? A. Analysing the trading results B. Entering transactions in the ledger C. Preparing year-end financial statements D. Providing information for...

-

Mary Tokar is comparing a U.S. GAAP -based company to a company that uses IFRS. Both companies report non-trading equity investments. The IFRS company reports unrealized losses on these investments...

-

Wang Corp. had $100,000 of 7%, $20 par value preference shares and 12,000 shares of $25 par value ordinary shares outstanding throughout 2011. (a) Assuming that total dividends declared in 2011 were...

-

On February 1, 2010, Gruber Corporation issued 3,000 shares of its 5 par value ordinary shares for land worth 31,000. Prepare the February 1, 2010, journal entry.

-

Portfolio return and beta Personal Finance Problem Jamie Peters invested $ 1 1 3 , 0 0 0 to set up the following portfolio one year ago: a . Calculate the portfolio beta on the basis of the original...

-

. Emerson Cammack wishes to purchase an annuity contract that will pay him $7,000 a year for the rest of his life. The Philo Life Insurance Company figures that his life expectancy is 20 years, based...

-

Integrity Inc. can sell 20-year, $1,000 par value bonds paying semi-annual interests with a 10% coupon. The bonds can be sold for $1,050 each; flotation cost of $50 per bond will be incurred in this...

Study smarter with the SolutionInn App