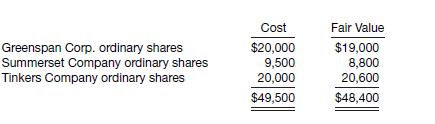

Lexington Co. has the following equity investments on December 31, 2015 (its first year of operations). During

Question:

Lexington Co. has the following equity investments on December 31, 2015 (its first year of operations).

During 2016, Summerset Company shares were sold for \($9\),200, the difference between the \($9\),200 and the “fair value” of \($8\),800 being recorded as a “Gain on Sale of Investments.” The market price of the shares on December 31, 2016, was Greenspan Corp. shares \($19\),900, Tinkers Company shares \($20\),500.

Instructions

(a) What justification is there for valuing these investments at fair value and reporting the unrealized gain or loss in income?

(b) How should Lexington Company apply this rule on December 31, 2015? Explain.

(c) Did Lexington Company properly account for the sale of the Summerset Company shares?

Explain.

(d) Are there any additional entries necessary for Lexington Company at December 31, 2016, to reflect the facts on the financial statements in accordance with IFRS? Explain.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield