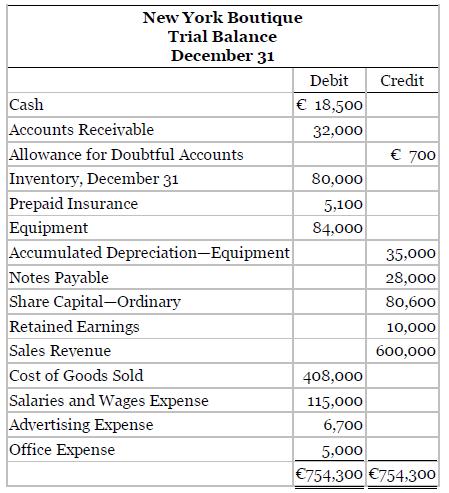

The following is the December 31 trial balance of New York Boutique. Instructions a. Construct T-accounts and

Question:

The following is the December 31 trial balance of New York Boutique.

Instructions

a. Construct T-accounts and enter the balances shown.

b. Prepare adjusting journal entries for the following and post to the T-accounts. (Omit explanations.) Open additional T-accounts as necessary. The books are closed yearly on December 31.

1. Bad debt expense is estimated to be €1,400.

2. Equipment is depreciated based on a 7-year life (no residual value).

3. Insurance expired during the year, €2,550.

4. Interest accrued on notes payable, €3,360.

5. Salaries and wages earned but not paid, €2,400.

6. Advertising paid in advance, €700.

7. Office supplies on hand, €1,500, charged to Office Expense when purchased.

c. Prepare closing entries and post to the accounts.

Step by Step Answer:

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield