You have been assigned to examine the financial statements of Zarle Company for the year ended December

Question:

You have been assigned to examine the financial statements of Zarle Company for the year ended December 31, 2022. You discover the following situations.

1. Depreciation of $3,200 for 2022 on delivery vehicles was not recorded.

2. The physical inventory count on December 31, 2021, improperly excluded merchandise costing $19,000 that had been temporarily stored in a public warehouse. Zarle uses a periodic inventory system.

3. A collection of $5,600 on account from a customer received on December 31, 2022, was not recorded until January 2, 2023.

4. In 2022, the company sold for $3,700 fully depreciated equipment that originally cost $25,000. The company credited the proceeds from the sale to the Equipment account.

5. During November 2022, a competitor company filed a patent-infringement suit against Zarle claiming damages of $220,000. The company’s legal counsel has indicated that an unfavorable verdict is probable and a reasonable estimate of the court’s award to the competitor is $125,000. The company has not reflected or disclosed this situation in the financial statements.

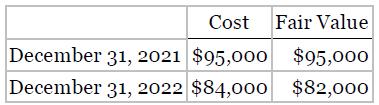

6. Zarle has a portfolio of investments that it manages to profit from short-term price changes. No entry has been made to adjust to fair value. Information on cost and fair value is as follows.

7. At December 31, 2022, an analysis of payroll information shows salaries and wages payable of $12,200. The Salaries and Wages Payable account has a balance of $16,000 at December 31, 2022, which was unchanged from its balance at December 31, 2021.

8. A large piece of equipment was purchased on January 3, 2022, for $40,000 and was charged to Maintenance and Repairs Expense. The equipment is estimated to have a service life of 8 years and no residual value. Zarle normally uses the straight-line depreciation method for this type of equipment.

9. A $12,000 insurance premium paid on July 1, 2021, for a policy that expires on June 30, 2024, was charged to insurance expense.

10. A trademark was acquired at the beginning of 2021 for $50,000. No amortization has been recorded since its acquisition. The maximum allowable amortization period is 10 years.

Instructions

Assume the trial balance has been prepared but the books have not been closed for 2022. Assuming all amounts are material, prepare journal entries showing the adjustments that are required. Ignore income tax considerations.

Step by Step Answer:

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield