At the beginning of 2020, Brett Company decided to change from the FIFO to the average cost

Question:

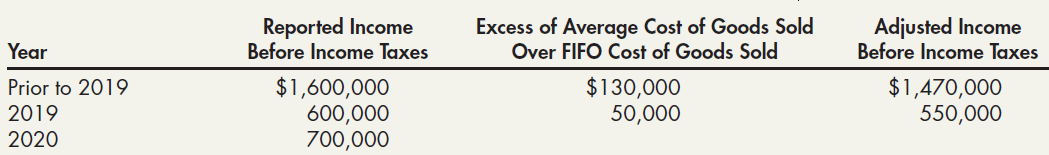

At the beginning of 2020, Brett Company decided to change from the FIFO to the average cost inventory cost flow assumption for financial reporting purposes. The following data are available in regard to its pretax operating income and cost of goods sold:

The income tax rate is 21%, and the company received permission from the IRS to also make the change for income tax purposes. Brett has a simple capital structure, with 100,000 shares of common stock outstanding. Brett computed its reported income before income taxes in 2020 using the newly adopted inventory cost flow method. Brett’s 2019 and 2020 revenues were $1,500,000 and $1,750,000, respectively. Its retained earnings balances at the beginning of 2019 and 2020 (unadjusted) were $1,120,000 and $1,540,000, respectively. Brett paid no dividends in any year.

Required:

1. Prepare the journal entry at the beginning of 2020 to reflect the change.

2. At the end of 2020, prepare comparative income statements for 2020 and 2019. Notes to the financial statements are not necessary.

3. At the end of 2020, prepare comparative retained earnings statements for 2020 and 2019.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach