Berg Company began operations on January 1, 2019, and uses the FIFO method in costing its raw

Question:

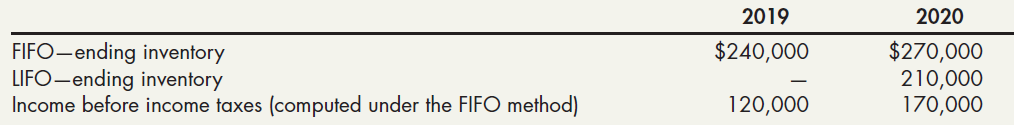

Berg Company began operations on January 1, 2019, and uses the FIFO method in costing its raw materials inventory. During 2020, management is contemplating a change to the LIFO method and is interested in determining what effect such a change will have on net income. Accordingly, the following information has been developed:

Required:

What is the effect on income before income taxes in 2020 of a change to the LIFO method?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Question Posted: