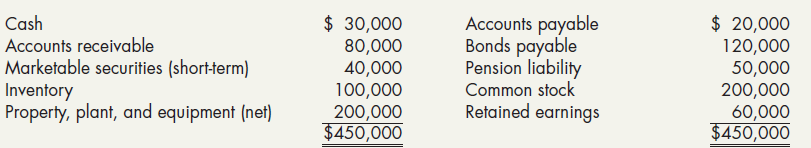

Hamilton Companys balance sheet on January 1, 2019, was as follows: Korbel Company is considering purchasing Hamilton

Question:

Hamilton Company’s balance sheet on January 1, 2019, was as follows:

Korbel Company is considering purchasing Hamilton (a privately held company) and discovers the following about Hamilton:

a. No allowance for doubtful accounts has been established. A $10,000 allowance is considered appropriate.

b. Marketable securities are valued at cost. The current market value is $60,000.

c. The LIFO inventory method is used. The FIFO inventory of $140,000 would be used if the company is acquired.

d. Land, included in property, plant, and equipment, which is recorded at its cost of $50,000, is worth $120,000.

The remaining property, plant, and equipment is worth 10% more than its depreciated cost.

e. The company has an unrecorded trademark that is worth $70,000.

f. The company’s bonds are currently trading for $130,000.

g. The pension liability is understated by $40,000.

Required:

1. Compute the amount of goodwill if Korbel agrees to pay $500,000 cash for Hamilton.

2. Next Level What are the reasons that the book value of Hamilton’s net identifiable assets differ from their market value?

3. Prepare the journal entry to record the acquisition on the books of Korbel assuming Hamilton is liquidated.

4. If Korbel agrees to pay only $400,000 cash, how much goodwill exists?

5. If Korbel pays only $400,000 cash, prepare the journal entry to record the acquisition on its books, assuming Hamilton is liquidated.

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach