In Fisk Companys negotiations with its employees union on January 1, 2019, the company agreed to an

Question:

In Fisk Company’s negotiations with its employees’ union on January 1, 2019, the company agreed to an amendment that increased the employee benefits based on services rendered in prior periods. This resulted in an $80,000 prior service cost that increased the projected benefit obligation of the company. Due to financial constraints, Fisk decided not to fund the total increase in its pension obligation at that time. Prior to 2019, it had been Fisk’s policy to fund only some of its pension expense each year so that the fair value of the plan assets at the end of the year was less than the year-end projected benefit obligation. As a result, Fisk reported an accrued/prepaid pension cost liability of $40,000 on its December 31, 2018, balance sheet.

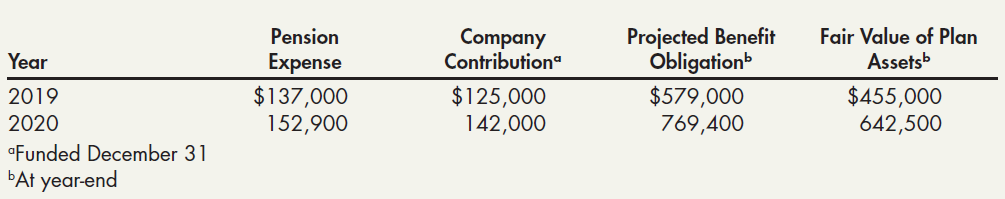

Fisk appropriately amortized the prior service cost over a 10-year service life as a component of pension expense in 2019 and 2020. The resulting pension and other information for 2019 and 2020 are as follows:

Required:

1. Prepare all the journal entries related to Fisk’s pension plan for 2019.

2. List the amounts of any accounts related to Fisk’s pension plan to be reported on the company’s December 31, 2019, balance sheet. Indicate in what sections they would be reported.

3. Prepare all the journal entries related to Fisk’s pension plan for 2020.

4. List the amounts of any accounts related to Fisk’s pension plan to be reported on the company’s December 31, 2020, balance sheet. Indicate in what sections they would be reported.

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach