Olmstead Corporations capital structure is as follows: The following additional information is available: 1. On September 1,

Question:

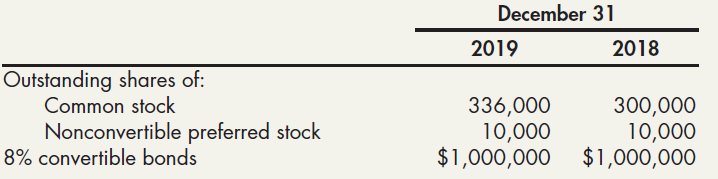

Olmstead Corporation’s capital structure is as follows:

The following additional information is available:

1. On September 1, 2019, Olmstead sold 36,000 additional shares of common stock.

2. Net income for the year ended December 31, 2019, was $750,000.

3. During 2019, Olmstead paid dividends of $3 per share on its nonconvertible preferred stock.

4. The 8% convertible bonds are convertible into 40 shares of common stock for each $1,000 bond.

5. Unexercised compensatory share options to purchase 30,000 shares of common stock at $20.50 per share were outstanding at the beginning and end of 2019. The average market price of Olmstead’s common stock was $36 per share during 2019. The market price was $33 per share at December 31, 2019. The unrecognized compensation cost (net of tax) related to the options is $2 per share.

6. Warrants to purchase 20,000 shares of common stock at $38 per share were attached to the preferred stock at the time of issuance. The warrants, which expire on December 31, 2024, were outstanding at December 31, 2019.

7. Olmstead’s effective income tax rate was 30% for 2018 and 2019.

Required:

(Show supporting computations in good form, and round earnings per share to the nearest penny.)

1. Compute the number of shares that should be used for the computation of basic earnings per share for the year ended December 31, 2019.

2. Compute the basic earnings per share for the year ended December 31, 2019.

3. Compute the number of shares that should be used for the computation of diluted earnings per share for the year ended December 31, 2019.

4. Compute the diluted earnings per share for the year ended December 31, 2019.

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach