On January 1, 1998, Nolder Company changed its inventory cost flow method from FIFO to LIFO for

Question:

On January 1, 1998, Nolder Company changed its inventory cost flow method from FIFO to LIFO for its raw materials inventory. The change was made for both financial statement and income tax reporting purposes. Nolder uses the multiple-pools approach under which substantially identical raw materials are grouped into LIFO inventory pools;

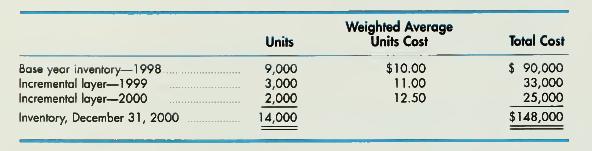

weighted average costs are used in valuing annual incremental layers. The composition of the December 31, 2000, inventory for the Class F inventory pool is as follows:

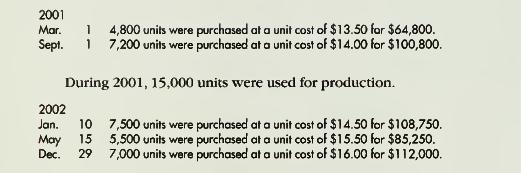

Inventory transactions for the Class F inventory pool during 2001 and 2002 were as follows:

During 2002, 16,000 units were used for production.

Instructions:

1. Compute the inventory (unit and dollar amounts) of the Class F inventory pool at December 31, 2001.

2. Compute the cost of Class F raw materials used in production for the year ended December 31, 2001.

3. Compute the inventory (unit and dollar amounts) of the Class F inventory pool at December 31, 2002.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780324013078

14th Edition

Authors: Fred Skousen, James Stice, Earl Kay Stice