Treasure Land Corporation incurred the following costs in 2025. Prepare the necessary 2025 journal entry or entries

Question:

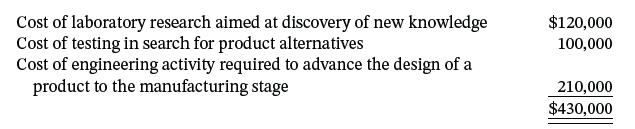

Treasure Land Corporation incurred the following costs in 2025.

Prepare the necessary 2025 journal entry or entries for Treasure Land.

Transcribed Image Text:

Cost of laboratory research aimed at discovery of new knowledge Cost of testing in search for product alternatives Cost of engineering activity required to advance the design of a product to the manufacturing stage $120,000 100,000 210,000 $430,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

Research a...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Treasure Land Corporation incurred the following costs in 2012. Cost of laboratory research aimed at discovery of new knowledge .... $120,000 Cost of testing in search for product alternatives...

-

Treasure Land Corporation incurred the following costs in 2014. Prepare the necessary 2014 journal entry(ies) for Treasure Land.

-

Treasure Land plc incurred the following costs in 2019. Cost of laboratory research aimed at discovery of new knowledge..................120,000 Cost of testing in search for product...

-

In a popular carnival ride called The Centrifuge, shown above, riders stand against the inside wall of a large cylinder, which starts spinning. The radius of the circle traveled by the riders is 4 ....

-

Who is responsible for establishing auditing standards for audits of public companies? Who is responsible for establishing accounting standards for public companies? Explain these two sets of...

-

These data represent the volumes in cubic yards of the largest dams in the United States and in South America. Construct a boxplot of the data for each region and compare the distributions. United...

-

Refer to Figure 3.55, which illustrates the convergence of TCP s AIMD algorithm. Suppose that instead of a multiplicative decrease, TCP decreased the window size by a constant amount. Would the...

-

The King Construction Company began work on a contract in 2007. The contract price is $4,000,000, and the company uses the percentage-of-completion method. Other information relating to the contract...

-

Sunshine Medical Center is a 350-bed not-for-profit organization. In 2020, they had 69,250 inpatient days and 19,233 discharges. Sunshine's accounting system reported $88,740,000 of inpatient service...

-

Thames Company's inventory records for its retail division show the following at December 31: E (Click the icon to view the accounting records.) At December 31, 10 of these units are on hand. Read...

-

Gershwin Corporation obtained a franchise from Sonic Hedgehog Inc. for a cash payment of $120,000 on April 1, 2025. The franchise grants Gershwin the right to sell certain products and services for a...

-

Presented below is information related to a copyright owned by Mare Company at December 31, 2025. Assume that Mare Company will continue to use this copyright in the future. As of December 31, 2025,...

-

A company begins its extraction of oil from a newly discovered oil field at t = 0. The rate of extraction, measured in thousands of barrels per year, is given by Calculate the number of barrels...

-

1. What are the threats being faced by Indian General Insurance Ltd. (IGIL)? 2. What are its traditional strengths? What 'business definitions' should it follow while capitalizing on its traditional...

-

You go to discuss the incident and the client's claims with your supervisor. As you retell the incident, it is clear that your supervisor is not comfortable. You ask your supervisor for advice on the...

-

Case Study Two: Rawlings Rawlings is an American sports equipment manufacturing company based in Town and Country, Missouri, and founded in 1887. Rawings specializes in baseball equipment and...

-

The discussion is for Administrating organizational change course. (we should write 300 words) Discussion question is: Refer to table 6.4 in your book. Think of a time when you were introduced to...

-

Content: Identify at least two resources for each of the four critical sections in the course project: Strategic Planning, Healthcare Reimbursement, Revenue Cycle Process, and Reimbursement...

-

Edwards Company began operations in February 2019. Edwards accounting records provide the following data for the remainder of 2019 for one of the items the company sells: Edwards uses a periodic...

-

The domain of the variable in the expression x 3/x + 4 is________.

-

Ayesha Corporation had the following tax information: In 2011, Ayesha suffered a net operating loss of $550,000, which it decided to carry back. The 2011 enacted tax rate is 29%. Prepare Ayesha's...

-

Kyle Inc. incurred a net operating loss of $580,000 in 2011. Combined income for 2008, 2009, and 2010 was $460,000. The tax rate for all years is 35%. Prepare the journal entries to record the...

-

Use the information for Kyle Inc. given in BE18-13, but assume instead that it is more likely than not that the entire tax loss carryforward will not be realized in future years. Prepare all the...

-

Metlock Limited has signed a lease agreement with Lantus Corp. to lease equipment with an expected lifespan of eight years, no estimated salvage value, and a cost to Lantus, the lessor of $170,000....

-

(International Finance) Computing a Currency changes = (e1 - e0 )/ e0 where e0 = old currency value e1 = new currency value (a) If the dinar devalues against the U.S. dollar by 45%, the U.S. dollar...

-

2. Fill in the time line for the Sawing Department. Use the time line to help you compute the number of equivalent units and the cost per equivalent unit in the Sawing Department for September Show...

Study smarter with the SolutionInn App