Truman Co. is a publicly held company whose shares are traded in the over-the-counter market. The shareholders

Question:

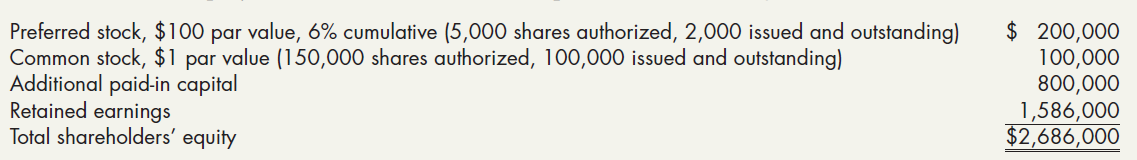

Truman Co. is a publicly held company whose shares are traded in the over-the-counter market. The shareholders’ equity at December 31, 2018, is comprised of the following:

Transactions during 2019 and other information relating to the shareholders’ equity accounts were as follows:

• February 2, 2019—Issued 13,000 shares of common stock to Wolf Co. in exchange for land. On the date issued, the stock had a market price of $11 per share. The land had a carrying value on Wolf ’s books of $135,000 and an assessed value for property taxes of $90,000.

• March 2, 2019—Purchased 5,000 shares of its own common stock to be held as treasury stock for $14 per share. Truman uses the cost method to account for treasury stock. Transactions in treasury stock are legal in Truman’s state of incorporation.

• May 11, 2019—Declared a property dividend of marketable securities held by Truman to common shareholders.

The securities had a carrying value of $600,000; fair values on relevant dates were:

Date of declaration (May 11, 2019)....................................... $720,000

Date of record (May 28, 2019) .................................................758,000

Date of distribution (June 4, 2019) ...........................................736,000

• October 1, 2019—Reissued 2,000 shares of treasury stock for $16 per share.

• November 2, 2019—Declared a cash dividend of $1.50 per share to all common shareholders of record November 16, 2019. The dividend was paid on November 26, 2019.

• December 21, 2019—Declared the required annual cash dividend on preferred stock for 2019. The dividend was paid on January 4, 2020.

• January 14, 2020—Before closing the accounting records for 2019, Truman became aware that no amortization had been recorded for 2018 for a patent purchased on July 1, 2018. The patent was properly capitalized at $320,000 and had an estimated useful life of 8 years when purchased. Truman’s income tax rate is 30%. The appropriate correcting entry was recorded on the same day.

• Adjusted net income for 2019 was $838,000.

Required:

Determine the amounts of each of the following items. Show supporting calculations.

1. Prior period adjustment

2. Preferred dividends

3. Common dividends—cash

4. Common dividends—property

5. Number of common shares issued at December 31, 2019

6. Total legal capital of common stock issued

7. Additional paid-in capital, including treasury stock transactions

8. Total dollar amount of treasury stock

9. Numerator used in calculation of 2019 earnings per share for the year

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach