Jakes Mechanics owns the following long-lived assets: Instructions a. Prepare depreciation adjusting entries using straight-line depreciation for

Question:

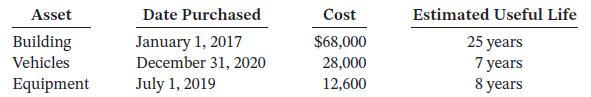

Jake’s Mechanics owns the following long-lived assets:

Instructions

a. Prepare depreciation adjusting entries using straight-line depreciation for Jake’s Mechanics for the year ended December 31, 2024.

b. For each asset, calculate its accumulated depreciation and carrying amount at December 31, 2024.

Asset Building Vehicles Equipment Date Purchased January 1, 2017 December 31, 2020 July 1, 2019 Cost $68,000 28,000 12,600 Estimated Useful Life 25 years 7 years 8 years

Step by Step Answer:

a b Dec 31 Depreciation Expense Accumulated Depreciation Building 168000 25 2720 per ...View the full answer

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

Jake's Mechanics owns the following long-lived assets: Instructions (a) Prepare depreciation adjusting entries for Jake's Mechanics for the year ended December 31, 2017. (b) For each asset, calculate...

-

Jake?s Mechanics owns the following long-lived assets: Instructions a. Prepare depreciation adjusting entries for Jake?s Mechanics for the year ended December 31, 2021. b. For each asset, calculate...

-

Since the early 1990s, woodstove sales have declined from 1,200,000 units per year to approximately 100,000 units per year. The decline has occurred because of (1) stringent new federal EPA...

-

Answer Problem 6.12 for a 90% CI. Refer to the data in Table 2.13. Regard this hospital as typical of Pennsylvania hospitals. Table 2.13: Hospital-stay data

-

Devons Central Processing Agency suffered a $ 560,000 loss due to a disaster that qualifies as an extraordinary item for financial statement purposes. The tax benefit of the loss amounts to $...

-

In what sense is a laser an amplifier of energy? Explain why this concept does not violate conservation of energy.

-

8. A U.S. firm has a $10,000,000 investment in a foreign subsidiary, and the U.S. dollar is weakening against the currency of the country in which the foreign entity is located, which is also the...

-

Condensed financial data of Minnie Hooper Company are shown below. Additional information:1. New plant assets costing $146,000 were purchased for cash during the year.2. Investments were sold at...

-

Harold Cooper, Bonnie Northrup, and Carlos Young invested 590,000, $120,000, and $90,000, respectively in a partnership. During its first year, the firm recorded a net income of $126,600. Prepare...

-

A company wants to build a website where user can register themselves and buy/renew health insurance policies. Also, they can process claims from a separate section on the website. Once logged in,...

-

The following independent items for Last Planet Theatre during the year ended December 31, 2024, may require a transaction journal entry, an adjusting entry, or both. The company records all prepaid...

-

On July 1, 2024, Majors Co. buys a three-year insurance policy for $12,750. Majors Co. has a December 31 year end. a. Journalize the purchase of the insurance policy. b. Prepare the year-end...

-

When the records of Hilda Corporation were reviewed at the close of 2017, the following errors were discovered. Instructions For each item, indicate by a check mark in the appropriate column whether...

-

Your company has a Microsoft 365 E5 subscription. You need to review the Advanced Analysis tab on emails detected by Microsoft Defender for Office 365. What type of threat policy should you...

-

(a) The Bright company is evaluating a project which will cost Rs 1,00,000 and will have no salvage value at the end of its 5-year life. The project will save costs of Rs. 40,000 a year. The company...

-

Dispatcher Collins is retiring after 30 years on the job. If each of the 38 officers in the department contributes $9 for a retirement gift, what is the total amount that could be spent on this gift

-

XYZ CO Adjusted Trial Balance Debit Credit Cash Accounts receivable Office supplies Prepaid rent $ 40 850 1 490 1 530 4 000 Office equipment Accumulated Depreciation Accounts payable 7 000 $ 450 1...

-

What positive outcomes could result from implementing job enlargement, job rotation, and job enrichment in an organization with which you are familiar? What objections or obstacles might be...

-

1. Did The Home Depot's sales revenues increase or decrease in the year ended February 2, 2014, as compared to the previous year? By how much? Calculate this change as a percentage of the previous...

-

Baxter, Inc., owns 90 percent of Wisconsin, Inc., and 20 percent of Cleveland Company. Wisconsin, in turn, holds 60 percent of Clevelands outstanding stock. No excess amortization resulted from these...

-

The post-closing trial balance of Jajoo Corporation at December 31, 2017, contains the following share- holders' equity accounts: $5 noncumulative preferred shares (10,000...

-

The adjusted trial balance for Pansy Paints Ltd. at December 31, 2017, is presented below. Pansy's income tax rate is 25% and journal entries for income tax expense have not yet been prepared. There...

-

The shareholders' equity accounts of Tmao, Inc. at December 31, 2016, are as follows: Preferred shares, $3 noncumulative, unlimited number authorized, 4,000 issued..........$400,000 Common shares,...

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App