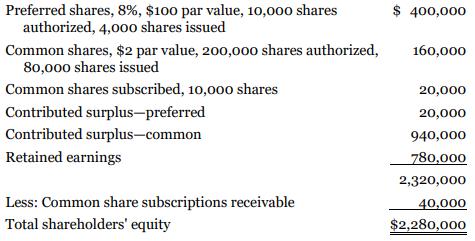

Laurentian Mills Ltd. had the following shareholders' equity at January 1, 2020. The contributed surplus accounts arose

Question:

Laurentian Mills Ltd. had the following shareholders' equity at January 1, 2020.

The contributed surplus accounts arose from amounts received in excess of the par value of the shares when issued. During 2020, the following transactions occurred:

- Equipment was purchased in exchange for 100 common shares. The shares' fair value on the exchange date was $12 per share.

- Sold 1,000 common shares and 100 preferred shares for the lump-sum price of $24,500. The common shares had a market price of $14 at the time of the sale.

- Sold 2,000 preferred shares for cash at $102 per share.

- All of the subscribers paid their subscription prices into the firm.

- The common shares subscribed were issued.

- Repurchased and retired 1,000 common shares at $15 per share. Calculate the amount recorded to contributed surplus on a pro rata basis and round to three decimal places.

- Net income for 2020 was $246,000.

Instructions

Prepare the shareholders' equity section for the company as at December 31, 2020.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

Question Posted: