Meraki Company uses the allowance method to estimate uncollectibles. The company produced the following aging of the

Question:

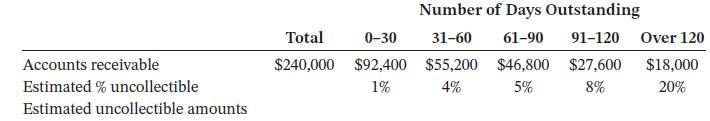

Meraki Company uses the allowance method to estimate uncollectibles. The company produced the following aging of the accounts receivable at year end:

Instructions

a. Calculate the total estimated uncollectibles based on the above information.

b. Prepare the year-end adjusting journal entry to record the bad debt expense using the aged uncollectible accounts receivable determined in (a). Assume the unadjusted balance in Allowance for Doubtful Accounts is a $9,600 debit.

c. In the following year, $6,000 is determined to be specifically uncollectible. Prepare the journal entry to write off the uncollectible account.

d. The company subsequently collects $6,000 from the account previously written off in part (c). Prepare the journal entry or entries necessary to restore the account and record the cash collection.

e. Comment on how your answers to (a) to (d) would change if Meraki used 4% of total accounts receivable, rather than aging the accounts receivable. What are the advantages to the company of aging the accounts receivable rather than applying a percentage to total accounts receivable?

Taking It Further

The accounts receivable clerk is worried that a mistake has been made in the Allowance for Doubtful Accounts. He believes that a debit balance in this account indicates that an error was made during the year. Explain to the clerk why a debit balance might exist in the account before the year-end adjusting entry is posted.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak