Refer to the information for Lu Corp. in BE13.20. Prepare any necessary adjusting entries that are associated

Question:

Refer to the information for Lu Corp. in BE13.20. Prepare any necessary adjusting entries that are associated with the asset retirement obligation and related expenses at December 31, 2020, assuming that Lu follows

(a) IFRS,

(b) ASPE.

Ignore production-related costs for this question and round amounts to the nearest dollar.

Data From BE13.20.

Lu Corp. erected and placed into service an offshore oil platform on January 1, 2020 at a cost of $10 million. Lu is legally required to dismantle and remove the platform at the end of its nine-year useful life. Lu estimates that it will cost $1 million to dismantle and remove the platform at the end of its useful life and that the discount rate to use should be 8%.

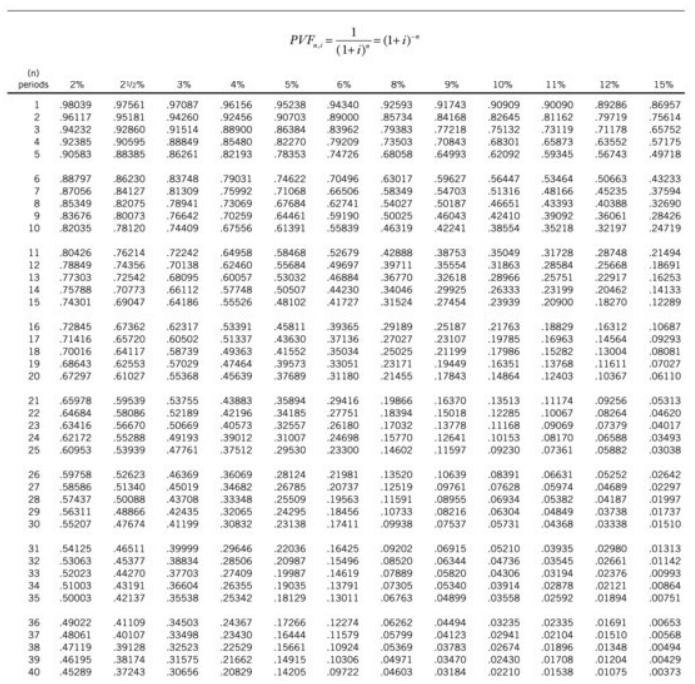

Table A.2

PVF= (1+i) (1+i) (n) periods 2% 3% 4% 5% 6% 8% 9% 10% 11% 12% 15% 98039 96117 94232 92385 97561 .95238 91743 90909 90090 86957 97087 94260 .91514 96156 .92456 88900 85480 82193 94340 89000 83962 79209 74726 92593 85734 79383 73503 68058 89286 79719 95181 92860 90595 88385 90703 84168 77218 70843 82645 75132 68301 .62092 81162 75614 65752 57175 49718 71178 63552 3 86384 73119 88849 86261 4 82270 78353 65873 59345 5. 90583 64993 56743 88797 83748 79031 .74622 .56447 50663 86230 84127 70496 66506 63017 58349 54027 59627 54703 50187 46043 42241 53464 48166 43393 39092 43233 37594 32690 87056 81309 78941 76642 75992 73069 .71068 .51316 46651 45235 40388 36061 8 85349 83676 82035 82075 BO073 78120 70259 .67556 67684 64461 61391 62741 59190 55839 50025 46319 42410 38554 28426 10 74409 35218 32197 24719 76214 74356 72242 .64958 58468 52679 42888 38753 35049 31728 28748 21494 11 12 13 B0426 78849 77303 75788 70138 .68095 66112 62460 60057 57748 55684 53032 49697 46884 39711 36770 35554 32618 29925 31863 28966 26333 23939 28584 25751 23199 25668 22917 18691 16253 14133 72542 14 15 70773 69047 50507 48102 44230 41727 34046 31524 20462 18270 ,74301 64186 .55526 27454 20900 12289 16 72845 67362 62317 .53391 45811 39365 29189 25187 23107 21199 21763 19785 17986 16351 .14864 18829 .16312 10687 .09293 .08081 .07027 .06110 17 18 71416 70016 68643 65720 64117 62553 61027 .60502 58739 57029 51337 49363 47464 43630 41552 39573 37136 35034 33051 31180 27027 16963 15282 13768 14564 25025 13004 19 20 23171 21455 19449 .11611 67297 .55368 45639 37689 .17843 12403 .10367 21 65978 59539 53755 43883 35894 29416 19866 16370 15018 13513 12285 .11168 11174 .09256 .05313 04620 22 64684 63416 62172 58086 .52189 50669 42196 40573 39012 34185 27751 26180 24698 18394 10067 08264 .07379 06588 .05882 23 56670 32557 17032 13778 12641 11597 09069 04017 24 25 55288 53939 49193 47761 31007 29530 15770 10153 09230 08170 07361 .03493 03038 60953 37512 23300 14602 26 59758 52623 46369 45019 36069 28124 26785 25509 21981 20737 13520 10639 08391 06631 05974 05252 .04689 04187 .03738 02642 27 28 58586 .57437 56311 51340 50088 48866 34682 33348 32065 12519 11591 10733 09761 08955 .08216 .07628 06934 .02297 43708 19563 05382 .01997 29 30 42435 18456 24295 23138 06304 .05731 04849 .04368 01737 01510 55207 47674 41199 30832 17411 09938 07537 03338 31 46511 .54125 53063 39999 29646 28506 22036 20987 16425 09202 .06915 05210 03935 02980 .01313 32 33 52023 51003 50003 45377 44270 43191 42137 38834 37703 36604 15496 14619 13791 13011 .08520 .07889 07305 .06763 .06344 .05820 .05340 .04899 04736 .04306 .03914 03545 03194 02878 .02661 02376 02121 .01142 00993 00864 .00751 27409 19987 19035 18129 26355 34 35 35538 25342 03558 02592 01894 36 .17266 49022 48061 41109 40107 34503 33498 24367 12274 11579 06262 .05799 04494 04123 .03235 02335 01691 01510 01348 01204 .00653 .00568 37 38 39 23430 22529 21662 20829 16444 15661 02941 .02674 47119 46195 45289 .02104 01896 01708 .01538 39128 32523 10924 10306 09722 05369 .03783 .03470 .03184 .00494 38174 31575 .04971 00429 14915 .14205 02430 .02210 40 37243 30656 04603 01075 .00373

Step by Step Answer:

a IFRS Depreciation Expense 1 55583 Accumulated Depreciation Drilling Platform 55583 1 500249 9 year...View the full answer

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

Students also viewed these Business questions

-

Lu Corp. erected and placed into service an offshore oil platform on January 1, 2017 at a cost of $10 million. Lu is legally required to dismantle and remove the platform at the end of its nine-year...

-

Lu Corp. erected and placed into service an offshore oil platform on January 1, 2014, at a cost of $10 million. Lu is legally required to dismantle and remove the platform at the end of its nine-year...

-

Lu Corp. erected and placed into service an offshore oil platform on January 1, 2020 at a cost of $10 million. Lu is legally required to dismantle and remove the platform at the end of its nine-year...

-

The boundedness theorem shows how the bottom row of a synthetic division is used to place upper and lower bounds on possible real zeros of a polynomial function. Let P(x) define a polynomial function...

-

(a) Androsterone, a secondary male sex hormone, has the systematic name 3a-hydroxy- 5a-androstan-17-one. Give a three-dimensional formula for androsterone. (b) Norethynodrel, a synthetic steroid that...

-

Discuss how the need for flexibility affects human resource management.

-

Finding Probabilities Use the probability distribution you made for Exercise 28 to find the probability of randomly selecting a World Series that consisted of (a) four games, (b) at least five games,...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Which of the following statements relating to the periodic inventory system is incorrect? A The balance in the Inventory account represents the cost of the inventory on hand at the beginning of the...

-

Creekside Products Inc. is considering replacing an old piece of machinery, which cost $315,000 and has $130,000 of accumulated depreciation to date, with a new machine that costs $275,000. The old...

-

Selzer Equipment Limited sold 500 Rollomatics on account during 2020 for $6,000 each. Ignore any cost of goods sold. During 2020, Selzer spent $30,000 servicing the two-year warranties that are...

-

Cool Sound Ltd. manufactures a line of amplifiers that carry a three-year warranty against defects. Based on experience, the estimated warranty costs related to dollar sales are as follows: first...

-

Optical Products Company reported the following stockholders equity on its balance sheet: Requirements 1. What caused Opticals preferred stock to decrease during 2019? Cite all possible causes. 2....

-

We are writing a business plan about expanding Robinson Development Group's business into Mexico. They do residential as well as business development in Virginia and have branched out on the East...

-

Political ideologies can influence trade. Although Russia's constitution lists it as a Federal Democratic State, many news outlets call it a "Fake Democracy". Now that Russia has invaded Ukraine, the...

-

A facultative oxidation pond is to be designed for a community of 5000 people. Summer wastewater flow is 2000 m 3 /d, and the BOD 5 is 180 g/m 3 . Winter flow and BOD 5 values are 6000 m 3 /d and 90...

-

Watch the video "Black Diamond: Managing in a Global Environment" https://youtu.be/lc29Ro9TOKg Describe at least two environmental factors that affect this business and summarize how the managers are...

-

In social media, one size does not fit all. Social media includes traditional platforms such as Facebook and Instagram, but it also includes podcasts, blogs, and video mediums. Each platform and...

-

Find the correlation coefficient r for X and Y in Exercise 6.5. Data from Exercise 6.5 Refer to the Canadian Journal of Civil Engineering (Jan. 2013) investigation of the use of variable speed limits...

-

In the figure, two loudspeakers, separated by a distance of d1 = 2.63 m, are in phase. Assume the amplitudes of the sound from the speakers are approximately the same at the position of a listener,...

-

The following financial statement was prepared by employees of Intellisys Corporation, which follows ASPE: Intellisys Corporation Income Statement Year Ended December 31, 2020 Sales revenue Gross...

-

Delray Inc. follows IFRS and has the following amounts for the year ended December 31, 2020: gain on disposal of FV-NI investments (before tax), $15,000; loss from operation of discontinued division...

-

The following account balances were included in the trial balance of Reid Corporation at June 30, 2020: During 2020, Reid incurred production salary and wage costs of $710,000, consumed raw materials...

-

Famas Llamas has a weighted average cost of capital of 8.8 percent. The companys cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the...

-

The common stock of a company paid 1.32 in dividens last year. Dividens are expected to gros at an 8 percent annual rate for an indefinite number of years. A) If the company's current market price is...

-

(1 point) Bill makes annual deposits of $1900 to an an IRA earning 5% compounded annually for 14 years. At the end of the 14 years Bil retires. a) What was the value of his IRA at the end of 14...

Study smarter with the SolutionInn App