Reyes Rides is owned by Jason Reyes. The company has an August 31 fiscal year end and

Question:

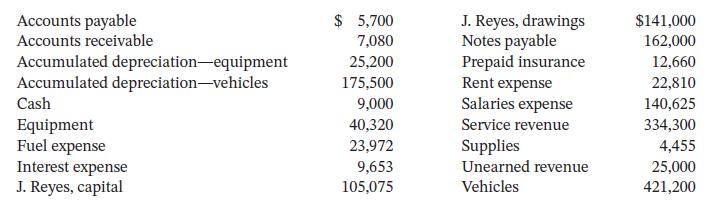

Reyes Rides is owned by Jason Reyes. The company has an August 31 fiscal year end and prepares adjustments on an annual basis. The following is an alphabetical list of its accounts at August 31, 2024, before adjustments. All accounts have normal balances.

Additional information:

1. On August 31, a physical count shows $850 of supplies on hand.

2. The insurance policy has a one-year term that began on November 1, 2023.

3. The equipment has an estimated useful life of 10 years. The vehicles have an estimated useful life of 12 years.

4. The company collects cash in advance for any special services requested by customers. As at August

31, the company has provided all but $4,500 of these services.

5. The note payable has an annual interest rate of 4.5%. Interest is paid on the first day of each month.

6. Employees are paid a combined total of $545 per day. At August 31, 2024, five days of salaries are unpaid. Employees do not work weekends.

7. On August 31, the company provided $1,350 of services for a senior citizens’ group. The group was not billed for the services until September 2.

8. Additional fuel costs of $620 have been incurred but not recorded. (Use the Accounts Payable account.)

Instructions

a. Prepare T accounts and enter the unadjusted trial balance amounts.

b. Journalize the annual adjusting entries at August 31, 2024.

c. Post the adjusting entries.

d. Prepare an adjusted trial balance at August 31, 2024.

Taking It Further

As at August 31, 2024, approximately how old are the equipment and vehicles?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak