Cash-settled: Sousa Minerals has a SARs program for managers. These individuals receive a cash payment after four

Question:

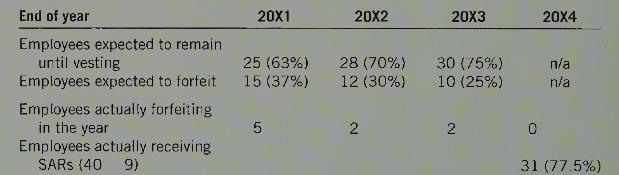

Cash-settled: Sousa Minerals has a SARs program for managers. These individuals receive a cash payment after four years of service, calculated as the excess of share price over \(\$ 2\). In early \(20 \mathrm{X}\), individuals in the 40 -member management team are granted a total of 100,000 SARs units. The payment is made at the end of \(20 X 4\). Data on estimated and actual retention:

The fair value of the entire 100,000 units was estimated to be \(\$ 100,000\) at the end of \(20 \mathrm{X} 1\), \(\$ 50,000\) at the end of \(20 \times 2\), and \(\$ 110,000\) at the end of \(20 \times 3\). The actual share price was \(\$ 2.90\) at the end of \(20 \mathrm{X} 4\).

Required:

1. Calculate compensation expense in each year of the SARs plan, and the balance of the SARs liability at the end of each year.

2. What evidence suggests that the level of retention must be revised at the end of 20X2?

3. Explain why compensation expense is volatile.

Step by Step Answer: