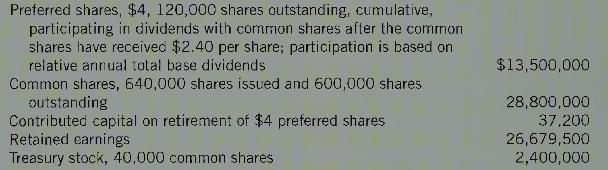

Compute Dividends, Retire Shares: Australia Ltd. reported the following items in shareholders' equity at 31 December 20X3:

Question:

Compute Dividends, Retire Shares: Australia Ltd. reported the following items in shareholders' equity at 31 December 20X3:

Required:

1. No dividends were declared in \(20 \mathrm{X} 1\) or \(20 \mathrm{X} 2\). In \(20 \mathrm{X} 3, \$ 6,500,000\) in cash dividends was declared but has not been recorded. How much would be distributed to each class of shares, as described above?

2. Prepare journal entries for the following transactions, which took place after the dividend in requirement 1 . The transactions occurred in chronological order:

a. Repurchase and retirement of 30,000 common shares for \(\$ 76.25\) per share.

b. Repurchase and retirement of \(5,000 \$ 4\) preferred shares for \(\$ 120\) per share.

c. Sale of 10,000 treasury shares at \(\$ 80\) per share.

d. Declaration and distribution of a \(10 \%\) stock dividend on common shares valued at \(\$ 77\) per share; there were fractional rights issued for 2,000 shares. The Board of Directors agreed that treasury shares would not receive the stock dividend.

Step by Step Answer: