Question: Computer Imaging Ltd. (CIL) established a formal pension plan 10 years ago to provide retirement benefits for all employees. The plan is noncontributory and is

Computer Imaging Ltd. (CIL) established a formal pension plan 10 years ago to provide retirement benefits for all employees. The plan is noncontributory and is funded through a trustee that invests all funds and pays all benefits as they become due. Vesting occurs when the employee reaches age 45 and has been employed by CIL ten years.

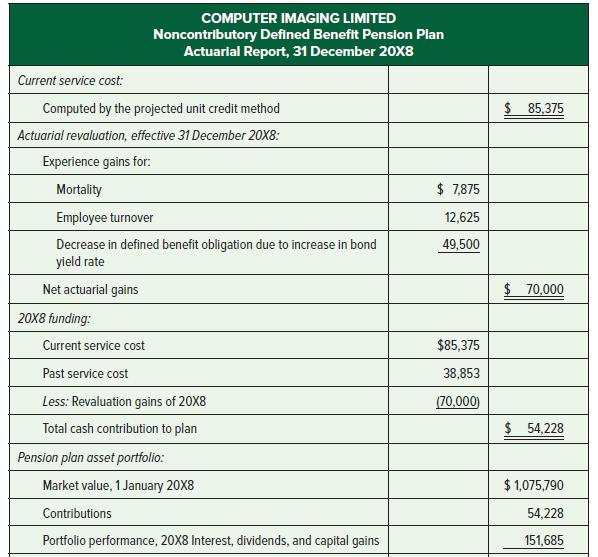

At the inception of the plan, past service cost (PSC) amounted to $300,000. The past service cost is being funded over ten years by level annual end-of-year payments calculated at 5%, which is a reasonable approximation of long-term borrowing rates (see actuarial report below for the funding amount). Each year, at the year-end, the company also funds an amount equal to current service cost less any new actuarial gains or plus any new actuarial losses on the pension obligation. The yield rate on corporate bonds with an appropriate currency and term is 6%.

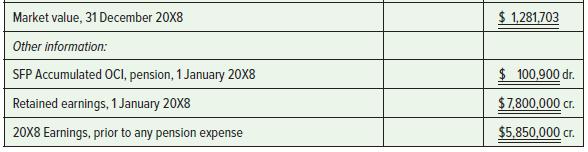

At the beginning of 20X8, the defined benefit obligation was $1,400,200. The fair value of investments was $1,075,790, and the net defined benefit liability on the SFP was $324,410.

The independent actuary’s biennial revaluation report follows:

Required:

1. Analyze the three elements of pension accounting for 20X8: service cost, net interest, and remeasurements. Prepare entries and also an entry for the contribution to the fund during 20X8.

2. Calculate 20X8 earnings after pension expense is recorded. Ignore any income tax. Also calculate comprehensive income, the closing balance of retained earnings, accumulated OCI, and the SFP net defined benefit liability as of 31 December 20X8. Prove that the SFP liability account represents the net defined benefit position of the pension fund.

Current service cost: COMPUTER IMAGING LIMITED Noncontributory Defined Benefit Pension Plan Actuarial Report, 31 December 20X8 Computed by the projected unit credit method Actuarial revaluation, effective 31 December 20X8: Experience gains for: Mortality Employee turnover Decrease in defined benefit obligation due to increase in bond yield rate Net actuarial gains 20X8 funding: Current service cost Past service cost Less: Revaluation gains of 20X8 Total cash contribution to plan Pension plan asset portfolio: Market value, 1 January 20X8 Contributions Portfolio performance, 20X8 Interest, dividends, and capital gains $ 7,875 12,625 49,500 $85,375 38,853 (70,000) $ 85,375 $ 70,000 $ 54,228 $ 1,075,790 54,228 151,685

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Requirement 1 Entries for three elements and fund contribution R... View full answer

Get step-by-step solutions from verified subject matter experts