Genis Inc. is a large distributor located in Atlantic Canada. Geniss draft financial statements show the following:

Question:

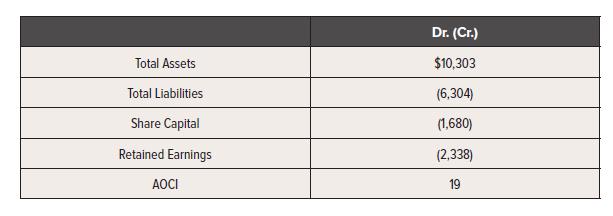

Genis Inc. is a large distributor located in Atlantic Canada. Genis’s draft financial statements show the following:

The company has the following items that have not yet been recorded as of the end of the period:

Share transactions:

• Dividends totalling $450,000 were been declared in December. The payment will be made in January 20X5. Genis has the following shares issued and outstanding:

- 120,000 no-par Class A preferred shares, $0.75 noncumulative, nonparticipating

- 8,000,000 no-par common shares

• 11,000 common shares were exchanged for services rendered in November/December.

The original quote provided by the consultant was $168,000 for the work performed.

The average trading price of Genis shares during November and December was $15 during the year.

Employee benefits:

The company sponsors both a defined benefit and a defined contribution plan, as follows:

Defined benefit plan:

• Current service cost: $30,450

• 1 January 20X4 defined benefit obligation: $3,506,000

• 1 January 20X4 plan assets: $3,692,000

• Actual return on plan assets: $207,000

• Interest rate on high-quality corporate bonds: 5.5%

• Plan curtailment (see note 1 below) resulting in the following:

- Past service cost of $320,000

- Actuarial gain due to change in demographic assumptions: $122,890

Defined contribution plan:

• 3% of gross salaries to be contributed by Genis

• Salaries paid to members enrolled in the defined contribution plan: $12,340,000

Note 1: On 30 December 20X4, Genis announced a plan to close one of its factories. The factory would close effective 1 February 20X5. Total termination costs of $890,000 will be paid out to employees in addition to the changes to the post-employment benefits noted above.

Genis has a bank loan that carries a debt covenant, requiring that the company maintain a debt-to-equity ratio of less than 2.5:1.

Required:

1. Prepare the journal entries for 20X3.

2. Calculate the revised debt-to-equity ratio, including all of the above transactions, and determine whether the covenant has been breached.

3. Calculate the debt-to-equity ratio, excluding the adjustments for the curtailment/ restructuring.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel