Return to the facts of A19-19. Assume instead that this pension plan is sponsored by a private

Question:

Return to the facts of A19-19. Assume instead that this pension plan is sponsored by a private company and ASPE applies.

Data From A19-19

Jones Manufacturing Inc. sponsored a defined benefit pension plan effective 1 January 20X7. The company uses the projected unit credit actuarial cost method for funding and accounting. Longterm corporate bonds have a yield of 4%. Employees were granted partial credit for past service. The past service obligation has been measured at $1,640,000 as of 1 January 20X7. The company will pay $200,000 (for past service) plus all current service cost to the pension plan trustee each 31 December beginning 31 December 20X7. This funding arrangement will continue for five years and then be re-evaluated.

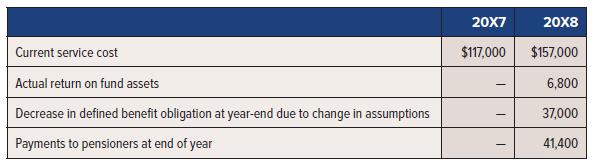

Data for 20X7 and 20X8:

Required:

Prepare a spreadsheet containing all relevant pension information for 20X7 and 20X8.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel