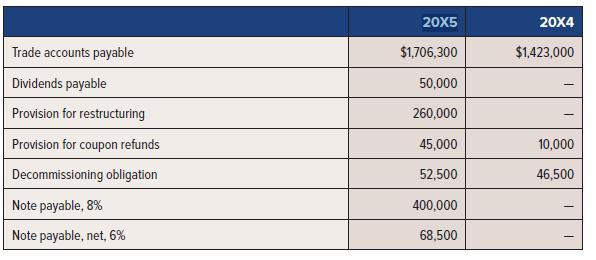

GYO Ltd. reports the following amounts on its statement of cash flows: 20X5 Other information: The

Question:

GYO Ltd. reports the following amounts on its statement of cash flows: 20X5

Other information:

• The 8% note payable is a bank loan due in 20X6, but negotiations for its renewal are taking place. Interest of $32,000 was paid at year-end.

• The provision for restructuring is based on the company’s plan to reduce its workforce in 20X6, according to a plan approved by the board of directors. The provision for restructuring is the estimated severance amounts that will be paid to employees affected by the restructuring.

• The decommissioning obligation relates to a leased premises that must be remediated at the end of the lease term in 20X9. The change in this account this year is due to interest.

• The 6% note payable reflects market interest rates at issuance but is, in fact, a no-interest, five-year note payable arranged with a supplier, for a piece of equipment. The note was originally recorded at its discounted amount of $89,000. Interest of $4,000 was recorded in 20X5.

• Dividends of $140,000 were declared during the year.

GYO uses the indirect method of presentation in the operating activities section of the statement of cash flows and follows the policy of reporting dividends paid in financing activities. Interest paid is included in operating activities.

Required:

1. For each item above, indicate whether the balance would be reported as a current or a long-term liability. For the 8% note payable, what condition must be met by year-end to ensure that the note may be classified as long-term?

2. List the items as they would appear on the statement of cash flows in 20X5. Include the amount, description, and classification.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel