Lakers Inc. reacquired a number of its own shares in one transaction in December of 2020. (Assume

Question:

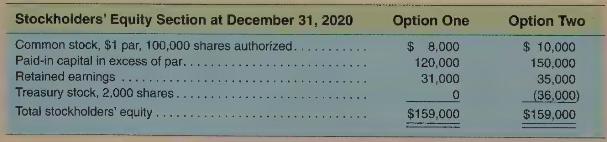

Lakers Inc. reacquired a number of its own shares in one transaction in December of 2020. (Assume no previous reacquisitions of stock.) Lakers Inc. could account for the reacquisition transaction using two different methods, illustrated as Option One and Option Two.

Required

a. Identify which method the company used in Option One to account for the reacquisition of common stock. Recreate the accounting entry to record the reacquisition of common stock.

b. Identify which method the company used in Option Two to account for the reacquisition of common stock. Recreate the accounting entry to record the reacquisition of common stock.

c. Determine the shares issued and shares outstanding on December 31, 2020 under Option One.

d. Determine the shares issued and shares outstanding on December 31, 2020 under Option Two.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781618533135

2nd Edition

Authors: Hanlon, Hodder, Nelson, Roulstone, Dragoo