On January 1, 2020. Keefe Corporation purchased equipment at a cost of ($ 100,000). The equipment has

Question:

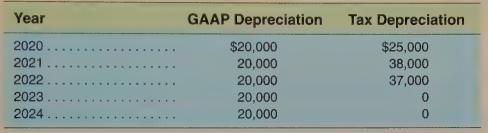

On January 1, 2020. Keefe Corporation purchased equipment at a cost of \(\$ 100,000\). The equipment has a fiveyear life and no salvage value. The depreciation schedule for tax and accounting purposes follows.

Pretax GAAP income for each year 2020 through 2023 is \(\$ 120,000\) and the tax rate is \(25 \%\). There are no other differences between tax and financial accounting income.

a. Prepare a schedule calculating the deferred tax balance at the end of years 2020-2023.

b. Record the income tax journal entry on December 31, 2020.

c. Record the income tax journal entry on December \(31,2021\).

d. Record the income tax journal entry on December 31, 2022.

e. Record the income tax journal entry on December \(31,2023\).

f. Repeat (a) through (d) instead assuming that the company expensed \(100 \%\) of the equipment in 2020 for tax purposes.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781618533135

2nd Edition

Authors: Hanlon, Hodder, Nelson, Roulstone, Dragoo