(Recognition of Profit and Balance Sheet Presentation, Percentage-of-Completion) On February 1, 2007, Amanda Berg Construction Company obtained...

Question:

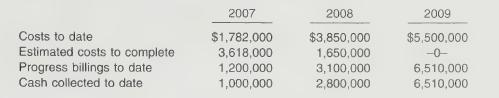

(Recognition of Profit and Balance Sheet Presentation, Percentage-of-Completion) On February 1, 2007, Amanda Berg Construction Company obtained a contract to build an athletic stadium. The stadium was to be built at a total cost of $5,400,000 and was scheduled for completion by September 1, 2009. One clause of the contract stated that Berg was to deduct $15,000 from the $6,600,000 billing price for each week that completion was delayed. Completion was delayed 6 weeks, which resulted in a $90,000 penalty. Below are the data pertaining to the construction period.

Instructions

(a) Using the percentage-of-completion method, compute the estimated gross profit recognized in the years 2007-2009.

(b) Prepare a partial balance sheet for December 31, 2008, showing the balances in the receivable and inventory accounts.

Step by Step Answer:

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield