Selected accounts from the SFP of ARM Co. at 31 August 20X3 and 20X2: Required: Calculate the

Question:

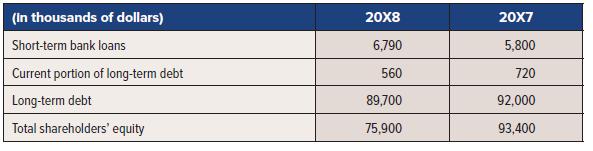

Selected accounts from the SFP of ARM Co. at 31 August 20X3 and 20X2:

Required:

Calculate the debt to equity ratio for ARM. What has happened to the leverage of the company, and why?

Transcribed Image Text:

(in thousands of dollars) Short-term bank loans Current portion of long-term debt Long-term debt Total shareholders' equity 20X8 6,790 560 89,700 75,900 20X7 5,800 720 92,000 93,400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

Selected accounts from the SFP of ARM Co at August 31 ...View the full answer

Answered By

Shadrack Mulunga

I am a Biochemistry by profession. However, I have explored different fields of study. My quest to explore new fields has helped me gain new knowledge and skills in Business, clinical psychology, sociology, organizational behavior and general management, and Project Management. I count my expertise in Project management, in particular, creation of Work Break Down Structure (WBS) and use of Microsoft Project software as one of my greatest achievement in Freelancing industry. I have helped thousands of BSC and MSC students to complete their projects on time and cost-effectively using the MS Project tool. Generally, I find happiness in translating my knowledge and expertise to success of my clients. So far, i have helped thousands of students to not only complete their projects in time but also receive high grades in their respective courses. Quality and timely delivery are the two key aspects that define my work. All those who hired my services always come back for my service. If you hire my services today, you will surely return for more. Try me today!

5.00+

154+ Reviews

289+ Question Solved

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Question Posted:

Students also viewed these Business questions

-

Selected accounts from the SFP of TMI Limited at 31 December 20X4 and 20X5, are presented below. Required: Calculate the change in cash for theyear. 20X5 20X4 As at 31 December Cash #1 Cash #2...

-

Selected accounts from the SFP of MNN Limited at 31 December 20X4 and 20X5 are presented below. Depreciation was $ 40,000 for equipment, $ 60,000 for buildings, and $ 75,000 for machinery. A new...

-

Selected accounts from the SFP of Norelco Limited at 31 December 20X4 and 20X5 are presented below. Norelco reported earnings of $ 280,000 in 20X5. There was a new $ 140,000 of notes payable this...

-

Write Python code that prompts the user to enter his or her age and assigns the users input to an integer variable named age.

-

Which of the indicators in Fig could be used for doing the titrations in Exercises 62 and 64? Fig Pheadl Red

-

Prepare a cost of production report when joint costs are produced. LO1

-

A manager wants to know how many units of each product to produce on a daily basis to achieve the highest profit. Production requirements for the products are shown in the following table. Material 1...

-

The accounts and transactions of Conner McAllister, Counselor and Attorney at Law, follow. INSTRUCTIONS Analyze the transactions. Record each in the appropriate T accounts. Use plus and minus signs...

-

Answer the question in the image below

-

SmartCo. has the following selected information for 20X6 and 20X7: The company pays taxes at the rate of 28%. Required: Calculate the times-debt-service-earned ratio for 20X6 and 20X7. Comment on...

-

Refer to the information provided in TR22-1 and in TR22-2. Data From TR 22-1 Riyers Inc. has the following selected information for its years ended June 30: Required: Calculate the...

-

a. What is the difference between a nominal and a real return? Which is more important to a typical investor? b. What is the Fisher effect?

-

Classic Auto Parts sells new and used auto parts. Although a majority of its sales are cash sales, it makes a significant amount of credit sales. During 2012, its first year of operations, Classic...

-

The following information is available for Market Inc. and Supply Inc. at December 31, 2012: Required a. What is the accounts receivable turnover for each of the companies for 2012 ? b. What is the...

-

Buck Novak, the chief executive officer of Novak Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay \($400,000\) cash at the...

-

Verify the log-likelihood in equation (16.4) for the Tobit model. In L = = In { 1-0 (x-di)} 1:y=di 122. + (y; - x) 02 (16.4) i:y;>di

-

Milo Company is considering the purchase of new equipment for its factory. It will cost \($250,000\) and have a \($50,000\) salvage value in five years. 1 he annual net income from the equipment is...

-

The truck has a mass of 4 Mg and mass center at G 1 , and the trailer has a mass of 1 Mg and mass center at G 2 , Determine the absolute maximum live moment in the bridge in Problem 669 if the...

-

Problem 3.5 (4 points). We will prove, in steps, that rank (L) = rank(LT) for any LE Rnxm (a) Prove that rank (L) = rank (LTL). (Hint: use Problem 3.4.) (b) Use part (a) to deduce that that rank(L) =...

-

At the end of its fiscal year, December 31, 2020, Javan Limited issued 200,000 share appreciation rights to its officers that entitled them to receive cash for the difference between the fair value...

-

Parsons Limited established a share appreciation rights program that entitled its new president, Brandon Sutton, to receive cash for the difference between the shares' fair value and a...

-

Discuss whether and how financial instruments are disclosed under IFRS, and the reason for the disclosure requirement.

-

Accounting changes fall into one of three categories. Identify and explain these categories and give an example of each one.

-

Machinery is purchased on May 15, 2015 for $120,000 with a $10,000 salvage value and a five year life. The half year convention is followed. What method of depreciation will give the highest amount...

-

Flint Corporation was organized on January 1, 2020. It is authorized to issue 14,000 shares of 8%, $100 par value preferred stock, and 514,000 shares of no-par common stock with a stated value of $2...

Study smarter with the SolutionInn App