The following two cases are independent. Case A At 31 December 20X3, QML Ltd. reports the following

Question:

The following two cases are independent.

Case A

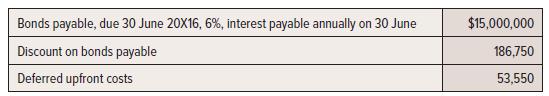

At 31 December 20X3, QML Ltd. reports the following on its statement of financial position:

Accrued interest payable of $450,000 was recorded on 31 December 20X3 ($15 million × 6% × 6/12) and the bond discount was correctly amortized to 31 December 20X3. On 1 March 20X4, 60% of the bond issue was bought back in the open market and retired at 98 plus accrued interest.

Required:

Provide the entries to record the interest and the retirement. Record interest and amortization only on the portion of the bond that is retired on 1 March 20X4; amortization of $429 must be recorded for the upfront costs and $1,494 on the discount.

Case B

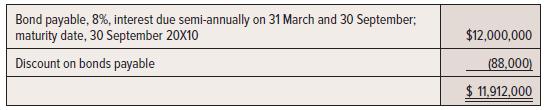

On 31 December 20X7, Dartmouth Co. has the following bond on the statement of financial position:

Accrued interest payable of $240,000 was recorded on 31 December 20X7 ($12 million × 8% × 3/12) and the bond discount was correctly amortized to 31 December 20X7. On 31 March 20X8, semi-annual interest was paid and the bond discount was amortized by a further $8,000.

Then, 30% of the bond was retired at a cost of $3,515,000 (exclusive of interest).

Required:

Provide the entries to record the bond interest and retirement on 31 March 20X8.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel