Thomas Incorporated started operations on 1 January 20X5 and purchased ($ 400,000) of capital assets. Information on

Question:

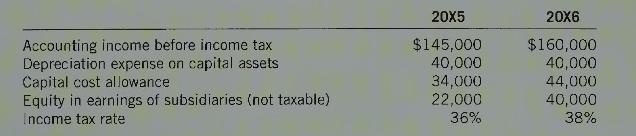

Thomas Incorporated started operations on 1 January 20X5 and purchased \(\$ 400,000\) of capital assets. Information on the first two years of operations is as follows:

Required:

Prepare all income tax journal entries for \(20 X 5\) and 20X6.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: