At December 31, 2019, Belmont Company had a net deferred tax liability of $375,000. An explanation of

Question:

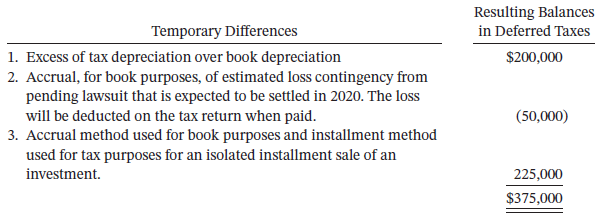

At December 31, 2019, Belmont Company had a net deferred tax liability of $375,000. An explanation of the items that compose this balance is as follows.

In analyzing the temporary differences, you find that $30,000 of the depreciation temporary difference will reverse in 2020, and $120,000 of the temporary difference due to the installment sale will reverse in 2020. The tax rate for all years is 20%.

Instructions

Indicate the manner in which deferred taxes should be presented on Belmont Company?s December 31, 2019, balance sheet.

Transcribed Image Text:

Resulting Balances in Deferred Taxes Temporary Differences 1. Excess of tax depreciation over book depreciation 2. Accrual, for book purposes, of estimated loss contingency from pending lawsuit that is expected to be settled in 2020. The loss will be deducted on the tax return when paid. 3. Accrual method used for book purposes and installment method used for tax purposes for an isolated installment sale of an investment. $200,000 (50,000) 225,000 $375,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 58% (12 reviews)

Deferred tax asset 50000 Deferred tax liability 425000 Net noncurre...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel

Question Posted:

Students also viewed these Business questions

-

Darrell Corporation reports under IFRS. At December 31, 2017, the company had a net deferred tax liability of $402,000. An explanation of the items that make up this balance follows: Instructions (a)...

-

At December 31, 2008, Belmont Company had a net deferred tax liability of $375,000. An explanation of the items that compose this balance is as follows. In analyzing the temporary differences, you...

-

At December 31, 2016, Belmont Company had a net deferred tax liability of $375,000. An explanation of the items that compose this balance is as follows. In analyzing the temporary differences, you...

-

a) The sustainable yield (Y) of a fishery is Y = E-0.5E where E denotes fishing effort. If the cost per unit of effort is 0.5 and the price of fish is 1, what is sustainable yield (i) under open...

-

Calculate the pH of a 0.20 M ammonium acetate (CH3COONH4) solution.

-

In some cities, media outlets publish a weekly list of restaurants that have been cited for health code violations by local health inspectors. What information problem is this feature designed to...

-

How can you prepare yourself to contribute value to an organization by appreciating other cultures?

-

You are a member of an independent consulting firm that specializes in serving the restaurant industry. Unlike many consulting firms that are extensions of audit firms, your firm has serious and in...

-

Airspot Motors, Inc. has $2,215,200 in current assets and $852,000 in current liabilities. The company's managers want to increase the firms inventory, which will be financed using short term debt....

-

1+1=2

-

Feagler Companys current income taxes payable related to its taxable income for 2020 is $460,000. In addition, Feaglers deferred tax asset decreased $20,000 during 2020. What is Feaglers income tax...

-

Mitchell Corporation had income before income taxes of $195,000 in 2020. Mitchells current income tax expense is $24,000, and deferred income tax expense is $15,000. Prepare Mitchells 2020 income...

-

After an audit report containing an unqualified opinion on a non-public clients financial statements was issued, the client decided to sell the shares of a subsidiary that accounts for 30 percent of...

-

4) This question concerns the simulation of price trajectories in the Black-Scholes model. We therefore want to simulate price vectors: (St St, Str); where tiit, i=0,1,..., n. The total number of...

-

Consider a pure exchange economy with two goods, (x,y), and two consumers, (1,2). Con- sumers' endowments are e (4,2) and e = (6,6) and their preferences are represented by utility functions: u(x,y)...

-

O The national highways agency releases information on the pro- portion of people not wearing seatbelts, aggregated by city. The data comes from random traffic stops conducted between 8am and 9am on...

-

Ivanka's Budgeted Income Statement You are the accountant for Ivanka Ltd which operates a small mixed business. The following estimates relate to the base year (Year 1): Sales of product A $100 000...

-

1. Implement the function of a XNOR gate by a 2 to 4 decoder. Use logic gates if needed at the output. 2. The following question is to design an octal to binary encoder. a) Write down the truth table...

-

Using the IELTS listening data presented in the previous exercise, practice evaluating data using confidence intervals. a. Compute the 80% confidence interval. b. How do the conclusion and the...

-

7. Baladna wants to analyze process that includes delivery by suppliers, production inside the company, transportation to to its customers and information systems. Then it also wants to find out...

-

On January 1, 2015, a machine was purchased for $90,000. The machine has an estimated salvage value of $6,000 and an estimated useful life of 5 years. The machine can operate for 100,000 hours before...

-

On January 1, 2016, Locke Company, a small machine-tool manufacturer, acquired for $1,260,000 a piece of new industrial equipment. The new equipment had a useful life of 5 years, and the salvage...

-

Romo Company spent $190,000 developing a new process, $45,000 in legal fees to obtain a patent, and $91,000 to market the process that was patented, all in the year 2017. How should these costs be...

-

1. (A nice inharitage) Suppose $1 were invested in 1776 at 3.3% interest compounded yearly a) Approximatelly how much would that investment be worth today: $1,000, $10,000, $100,000, or $1,000,000?...

-

Why Should not the government subsidize home buyers who make less than $120K per year. please explain this statement

-

Entries for equity investments: 20%50% ownership On January 6, 20Y8, Bulldog Co. purchased 25% of the outstanding common stock of $159,000. Gator Co. paid total dividends of $20,700 to all...

Study smarter with the SolutionInn App