At December 31, 2020, Cascade Company had a net deferred tax liability of $450,000. An explanation of

Question:

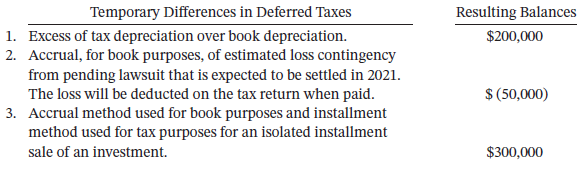

At December 31, 2020, Cascade Company had a net deferred tax liability of $450,000. An explanation of the items that compose this balance is as follows.

In analyzing the temporary differences, you find that $30,000 of the depreciation temporary difference will reverse in 2021, and $120,000 of the temporary difference due to the installment sale will reverse in 2021. The tax rate for all years is 40%.

Instructions

Indicate the manner in which deferred taxes should be presented on Cascade Company?s December 31, 2020, statement of financial position.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel

Question Posted: