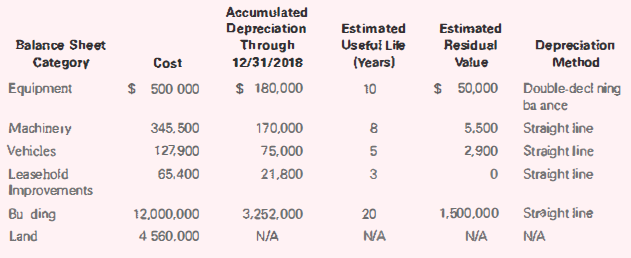

Disposal of Long-Term Operating Assets-Analysis, Depreciation, and Journal Information related to the long-term operating assets of Rivera

Question:

Disposal of Long-Term Operating Assets-Analysis, Depreciation, and Journal Information related to the long-term operating assets of Rivera Retail Distributors, Inc. ac December 31, 2018, is as follows:

The fiscal year-end of the company is December 31. The following events occurred during 2019:

1. On February 1, Rivera sold the vehicles to Wholesale Produce, Inc. for $15,000.

2. On March 31, all of Rivera's equipment and machinery was destroyed by a fire in one of its facilities.

3. On May 1, the equipment was replaced at a cost of $625,000. and the machinery cost the company $420.000 to replace. The estimated useful lives and residual values remained the same as specified for the original machinery and equipment. The company paid cash for the new assets.

Required

a. Prepare the journal entries required to record each of those events and to record depreciation expense at the end of the year.

b. Determine the ending net book value of Rivera's long-term operating assets on its December 31, 2019, balance sheet. Show the balance for each asset individually and in total.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella