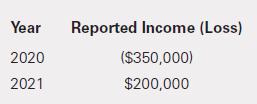

John Holland Incorporated provides you with the following information. The company does not report any book tax

Question:

John Holland Incorporated provides you with the following information.

The company does not report any book tax differences and is subject to a 21% income tax rate. Holland is a US Corporate tax filer.

Required

a. Prepare the journal entry required to record the effect of the NOL in 2020.

b. Prepare the journal entry required to record the tax provision in 2021

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 9780136946694

3rd Edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

Question Posted: