Question:

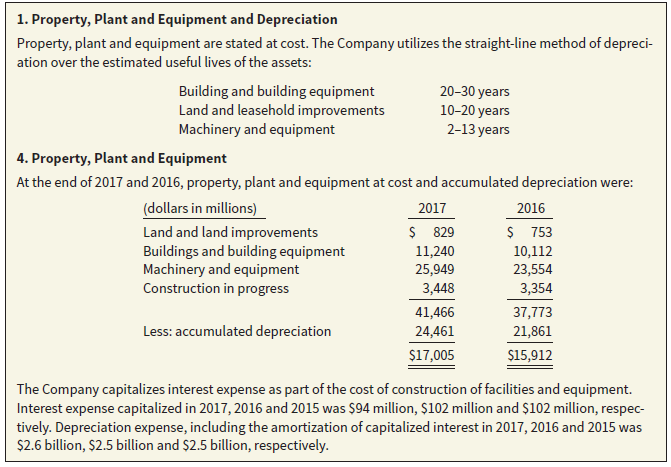

Johnson & Johnson, the world?s leading and most diversified healthcare corporation, serves its customers through specialized worldwide franchises. Each of its franchises consists of a number of companies throughout the world that focus on a particular healthcare market, such as surgical sutures, consumer pharmaceuticals, or contact lenses. Information related to its property, plant, and equipment in its 2017 annual report is shown in the following notes to the financial statements.

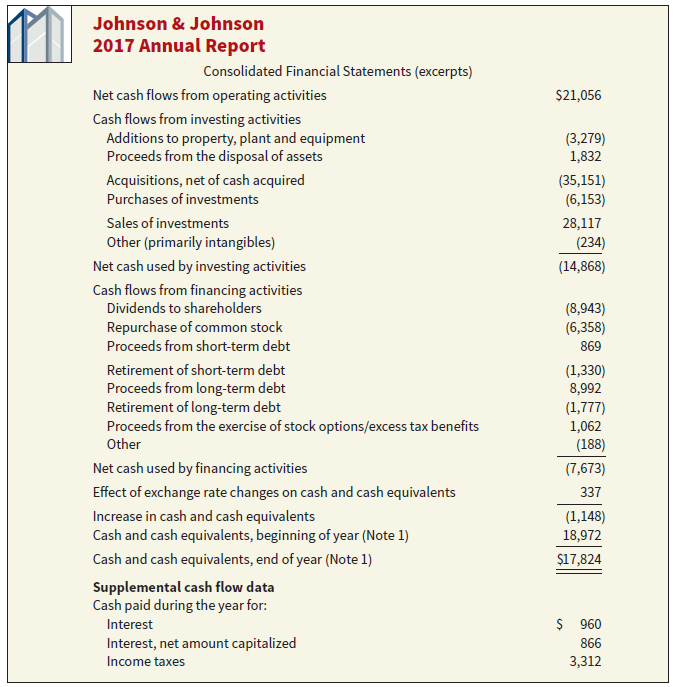

Johnson & Johnson provided the following selected information in its 2017 cash flow statement.

Instructions

a. What was the cost of buildings and building equipment at the end of 2017?

b. Does Johnson & Johnson use a conservative or liberal method to depreciate its property, plant, and equipment?

c. What was the actual interest paid by the company in 2017?

d. What is Johnson & Johnson?s free cash fl ow? From the information provided, comment on Johnson & Johnson?s financial flexibility.

Transcribed Image Text:

1. Property, Plant and Equipment and Depreciation Property, plant and equipment are stated at cost. The Company utilizes the straight-line method of depreci- ation over the estimated useful lives of the assets: Building and building equipment Land and leasehold improvements Machinery and equipment 20-30 years 10-20 years 2-13 years 4. Property, Plant and Equipment At the end of 2017 and 2016, property, plant and equipment at cost and accumulated depreciation were: (dollars in millions) 2017 2016 $ 753 Land and land improvements Buildings and building equipment Machinery and equipment Construction in progress $ 829 11,240 25,949 10,112 23,554 3,448 3,354 41,466 37,773 Less: accumulated depreciation 24,461 21,861 $17,005 $15,912 The Company capitalizes interest expense as part of the cost of construction of facilities and equipment. Interest expense capitalized in 2017, 2016 and 2015 was $94 million, $102 million and $102 million, respec- tively. Depreciation expense, including the amortization of capitalized interest in 2017, 2016 and 2015 was $2.6 billion, $2.5 billion and $2.5 billion, respectively. Johnson & Johnson 2017 Annual Report Consolidated Financial Statements (excerpts) Net cash flows from operating activities $21,056 Cash flows from investing activities Additions to property, plant and equipment Proceeds from the disposal of assets (3,279) 1,832 Acquisitions, net of cash acquired (35,151) (6,153) Purchases of investments Sales of investments 28,117 Other (primarily intangibles) (234) Net cash used by investing activities (14,868) Cash flows from financing activities Dividends to shareholders (8,943) (6,358) Repurchase of common stock Proceeds from short-term debt 869 (1,330) 8,992 Retirement of short-term debt Proceeds from long-term debt Retirement of long-term debt Proceeds from the exercise of stock options/excess tax benefits Other (1,777) 1,062 (188) Net cash used by financing activities (7,673) Effect of exchange rate changes on cash and cash equivalents 337 Increase in cash and cash equivalents Cash and cash equivalents, beginning of year (Note 1) (1,148) 18,972 Cash and cash equivalents, end of year (Note 1) $17,824 Supplemental cash flow data Cash paid during the year for: Interest $ 960 Interest, net amount capitalized 866 Income taxes 3,312