Listed below are several items and phrases associated with depreciation, depletion, and amortization. Pair each item from

Question:

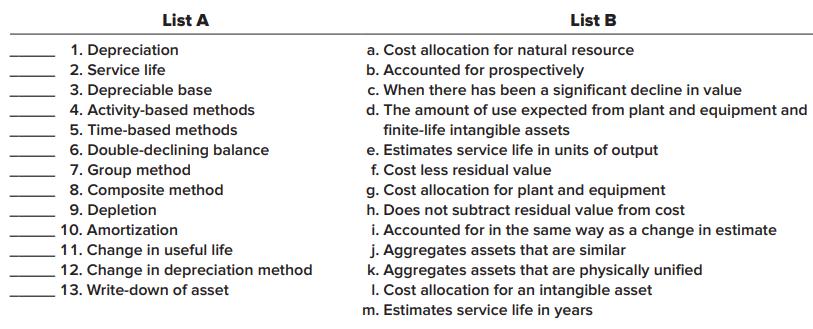

Listed below are several items and phrases associated with depreciation, depletion, and amortization. Pair each item from List A with the item from List B (by letter) that is most appropriately associated with it.

List A List B 1. Depreciation a. Cost allocation for natural resource 2. Service life b. Accounted for prospectively c. When there has been a significant decline in value 3. Depreciable base 4. Activity-based methods d. The amount of use expected from plant and equipment and finite-life intangible assets e. Estimates service life in units of output f. Cost less residual value g. Cost allocation for plant and equipment 5. Time-based methods 6. Double-declining balance 7. Group method 8. Composite method 9. Depletion h. Does not subtract residual value from cost i. Accounted for in the same way as a change in estimate j. Aggregates assets that are similar k. Aggregates assets that are physically unified 1. Cost allocation for an intangible asset m. Estimates service life in years 10. Amortization 11. Change in useful life 12. Change in depreciation method 13. Write-down of asset

Step by Step Answer:

1 Depreciation Cost allocation for plant and equipment is known as depreciation which satisfies matching concept It is distribution of cost of asset l...View the full answer

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Listed below are several terms and phrases associated with current liabilities. Pair each item from List A (by letter) with the item from List B that is most appropriately associated withit. List A...

-

Listed below are several terms and phrases associated with long-term debt. Pair each item from List A with the item from List B (by letter) that is most appropriately associated with it. List A List...

-

Listed below are several terms and phrases associated with inventory measurement. Pair each item from List A with the item from List B (by letter) that is most appropriately associated withit. List A...

-

Q2. (20 pts) Product structure tree of product A is given in the following table: B(2) A C(3) D(3) E(4) F(5) E(6) a. How many components of each kind to produce 5 product A? b. Draw operation process...

-

Use the data in MEAP93.RAW to answer this question. (i) Estimate the model math10 = (0 + (1 log (expend) + (2 lnchprg + u, and report the results in the usual form, including the sample size and...

-

The relative sensitivity of NMR lines for equal numbers of different nuclei at constant temperature for a given frequency is R (I+1) 3 whereas for a given field it is R B {(I+1)/I 2 } 3 . (a) From...

-

Relate the theory and evidence behind political economy views of trade policy. LO.1

-

Based on Dart Industries data in Exercise assume that a transfer price of $ 158 has been established and that 40,000 units of materials are transferred, with no reduction in the Components Divisions...

-

Directions: Answer the following nine questions in Microsoft Excel. Assume all investments / payments are made at the end of the month unless otherwise noted. You should use the videos, examples, and...

-

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2020. A simplified balance sheet for the firm appears below: Luther IndustriesBalance SheetAs of December 31,...

-

Belltone Company made the following expenditures related to its 10-year-old manufacturing facility: 1. The heating system was replaced at a cost of $250,000. The cost of the old system was not known....

-

On January 1, 2021, the general ledger of TNT Fireworks included the following account balances: During January 2021, the following transactions occurred: Jan. 1 Purchased equipment for $19,500. The...

-

At the instant = 30, the frame of the crane is rotating with an angular velocity of = 1.5 rad/s and angular acceleration of = 0.5 rad/s, while the boom AB rotates with an angular velocity of =...

-

Find the absolute maximum and absolute minimum values of the function f(x) (x-2)(x-5)+7 = on each of the indicated intervals. Enter 'NONE' for any absolute extrema that does not exist. (A) Interval =...

-

4. Roll one 10-sided die 12 times. The probability of getting exactly 4 eights in those 12 rolls is given by (a) 10 9 4 10 10 (b) HA 9 -HAA (c) 1 (d) 9 (c) 10 9 () 10

-

An employer has calculated the following amounts for an employee during the last week of June 2021. Gross Wages $1,800.00 Income Taxes $414.00 Canada Pension Plan $94.00 Employment Insurance $28.00...

-

Section Two: CASE ANALYSIS (Marks: 5) Please read the following case and answer the two questions given at the end of the case. Zara's Competitive Advantage Fashion houses such as Armani and Gucci...

-

The activity of carbon in liquid iron-carbon alloys is determined by equilibration of CO/CO2 gas mixtures with the melt. Experimentally at PT = 1 atm, and 1560C (1833 K) the equilibrated gas...

-

Mathematicians talk about the Fibonacci Sequence, which is a series of numbers defined recursively. The first Fibonacci number is 0, and the second is 1. From there on out, the nth Fibonacci number...

-

Explain the circumstances that could result in a long-term bank loan being shown in a statement of financial position as a current liability.

-

How should consolidated financial statements be reported this year when statements of individual companies were presented last year?

-

How should consolidated financial statements be reported this year when statements of individual companies were presented last year?

-

Simms Corp. controlled four domestic subsidiaries and one foreign subsidiary. Prior to the current year, Simms Corp. had excluded the foreign subsidiary from consolidation. During the current year,...

-

Interest Rate Parity Assume that interest rate parity holds and that 90-day risk-free securities yield 4% in the United States and 4.4% in Germany. In the spot market, 1 euro equals $1.43. What is...

-

Which of the following headings best describes and measures gearing? Financial position (risk). Liquidity. Profitability. Performance efficiency.

-

Green Industries uses the Aging Method to estimate the uncollectible accounts expense. On October 31, 2020, an aging of the Accounts Receivable produced the following information: 1-30 days past due...

Study smarter with the SolutionInn App