On January 1, 2021, NRC Credit Corporation leased equipment to Brand Services under a finance/sales-type lease designed

Question:

On January 1, 2021, NRC Credit Corporation leased equipment to Brand Services under a finance/sales-type lease designed to earn NRC a 12% rate of return for providing long-term financing. The lease agreement specified the following:a. Ten annual payments of $55,000 beginning January 1, 2021, the beginning of the lease and each December 31 thereafter through 2029.b. The estimated useful life of the leased equipment is 10 years with no residual value. Its cost to NRC was $316,412.c. The lease qualifies as a finance lease/sales-type lease.

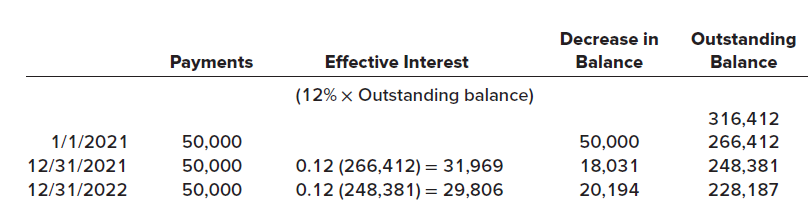

d. A 10-year service agreement with Quality Maintenance Company was negotiated to provide maintenance of the equipment as required. Payments of $5,000 per year are specified, beginning January 1, 2021. NRC was to pay this cost as incurred, but lease payments reflect this expenditure.e. A partial amortization schedule, appropriate for both the lessee and lessor, follows:

Required:Prepare the appropriate entries for both the lessee and lessor related to the lease on the following dates:1. January 1, 20212. December 31, 2021

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas