Refer to P14-31 above. Assume Honeymoon Corp. reports its financial results in accordance with ASPE. Required: a.

Question:

Refer to P14-31 above. Assume Honeymoon Corp. reports its financial results in accordance with ASPE.

Required:

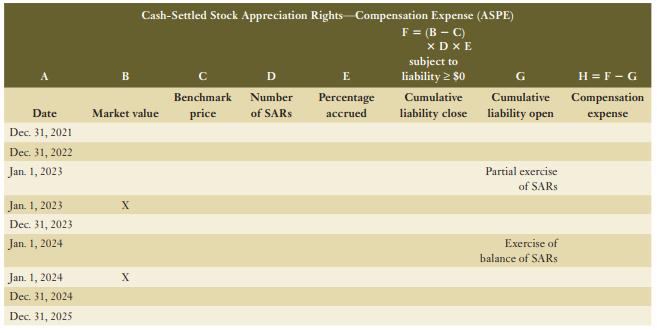

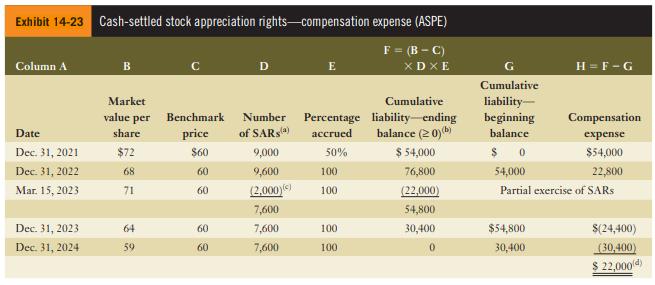

a. Complete the schedule below showing the amount of compensation expense for each of the five years, starting with 2021. If necessary, refer to the example illustrated in Exhibit 14-23 for guidance.

b. Prepare the journal entry at December 31, 2021, to record compensation expense.

c. Prepare the journal entry at December 31, 2022, to record compensation expense.

d. Prepare the journal entry at January 1, 2023, to record the partial exercise of the SARs.

e. Prepare the journal entry at December 31, 2023, to record compensation expense.

f. Prepare the journal entry at January 1, 2024, to record the exercise of the balance of the SARs.

g. Prepare the journal entry at December 31, 2024, to record compensation expense.

h. Prepare the journal entry at December 31, 2025, to record compensation expense.

Exhibit 14-23

P14-31

On January 1, 2021, Honeymoon Corp. established a cash-settled stock appreciation rights plan for its senior employees, the details of which are listed below:

■ 100,000 stock appreciation rights (SARs) were granted.

■ Each SAR entitled the employees to receive cash equal to the difference between the market price of the common shares and a benchmark price of $10.

■ The SARs vested after two years of service; they expired on December 31, 2025.

■ On January 1, 2023, 60,000 SARs were exercised. The market price of the shares remained at $12.

■ On January 1, 2024, the balance of the SARs were exercised. The market price of the shares remained at $13.

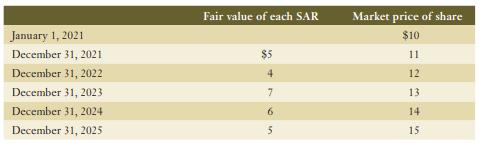

■ Pertinent stock-related data are set out below:

Step by Step Answer: