[This is a variation of E 12?12 modified to focus on the fair value option.]Colah Company purchased

Question:

[This is a variation of E 12?12 modified to focus on the fair value option.]Colah Company purchased $1 million of Jackson, Inc., 5% bonds at their face amount on July 1, 2021, with interest paid semi-annually. The bonds mature in 20 years but Colah planned to keep them for less than 3 years, and classified them as available for sale investments. When the bonds were acquired Colah decided to elect the fair value option for accounting for its investment. At December 31, 2021, the Jackson bonds had a fair value of $1.2 million. Colah sold the Jackson bonds on July 1, 2022 for $900,000.

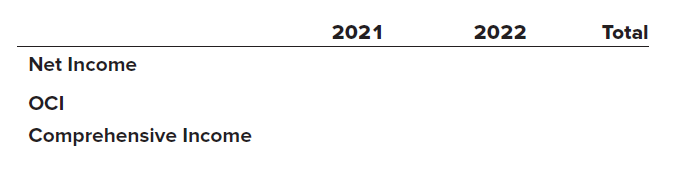

Required:1. Prepare Colah?s journal entries to recorda. The purchase of the Jackson bonds on July 1.b. Interest revenue for the last half of 2021.c. Any year-end 2021 adjusting entries.d. Interest revenue for the first half of 2022.e. Any entry or entries necessary upon sale of the Jackson bonds on July 1, 2022.2. Fill out the following table to show the effect of the Jackson bonds on Colah?s net income, other comprehensive income, and comprehensive income for 2021, 2022, and cumulatively over 2021 and 2022.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas