[This problem is a continuation of Problem 103 in Chapter 10 focusing on depreciation.] Required: For each

Question:

[This problem is a continuation of Problem 10–3 in Chapter 10 focusing on depreciation.]

Required:

For each asset classification, prepare a schedule showing depreciation for the year ended December 31, 2021, using the following depreciation methods and useful lives:

Land improvements—Straight line; 15 years

Building—150% declining balance; 20 years

Equipment—Straight line; 10 years

Automobiles—Units-of-production; $0.50 per mile

Depreciation is computed to the nearest month and whole dollar amount, and no residual values are used. Automobiles were driven 38,000 miles in 2021.

Problem 10–3

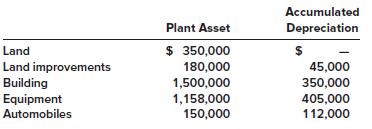

Accumulated Plant Asset Depreciation $ 350,000 Land Land improvements Building Equipment 180,000 45,000 1,500,000 350,000 1,158,000 150,000 405,000 112,000 Automobiles

Step by Step Answer:

The repaving of the parking lots is considered a repair that doesnt provide ...View the full answer

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

This short problem is a continuation of SP 5-1. Using the E-R diagram in from SP 5-1, write a description for each of the relationships in the diagram. In your description, include the cardinalities....

-

This short problem is a continuation of SP 5-1. Implement the E- R diagram from SP 5-1 as tables in a database software package, such as Access. Once the tables are created, link the tables together...

-

This problem is a continuation of Problem 3. Assume you ramp up production to 1,000 units per month in April, May, and June. Sales are expected to be 800 units in April and 1,100 units in both May...

-

Legally established titles to the ownership, use, and disposal of factors of production and goods and services that are enforceable in the courts are called : Group of answer choices Market power...

-

Write an equation that will produce the graph shown at right, with intercepts (5, 0), (2, 0), (1, 0), and (0, 60). -100

-

How many TCY of earth were generated from the excavation described in Exercise 5? Data from Exercise5 The Figure 16.1 tower crane photograph was taken during the shoring stage of another project. The...

-

What Is a Virtual Organization? (pp. 407413)

-

The administrators of Tiny College are so pleased with your design and implementation of their student registration/tracking system that they want you to expand the design to include the database for...

-

Johns Smoothie Stand at Utahs Wasatch Countys Demolition Derby sells bananas. If John bought 55 lbs. of bananas at $.34 per pound expecting 10% to spoil, how should he price his bananas to achieve...

-

An advertising project manager has developed a program for a new advertising campaign. In addition, the manager has gathered the time information for each activity, as shown in the table below. a....

-

[This is a variation of Exercise 112 modified to focus on depreciation for partial years.] On October 1, 2021, the Allegheny Corporation purchased equipment for $115,000. The estimated service life...

-

Refer to the situation described in BE 112. Calculate depreciation expense for 2021 and 2022 using sum-of-theyears-digits assuming the equipment was purchased on 1. January 1, 2021, 2. March 31,...

-

Geologists place tiltmeters on the sides of volcanoes to measure the displacement of the surface as magma moves inside the volcano. Although most tiltmeters today are electronic, the traditional...

-

Companies that engage international business do so in pursuit of a broad range of goals. Nonetheless, the text identifies key drivers, noting that the typical company expands operations...

-

How do lifestyle changes, such as urbanization or an aging population, affect consumer needs and preferences in our industry?

-

Verify that the following general thermodynamic property relationships are valid for the specific case of an ideal gas: (a) T = au (b) P = -9) av

-

Performance management systems that do not make true contribution to the organizational goals are not true performance management systems. List and describe at least five contributions a good...

-

How do cognitive biases, such as confirmation bias and anchoring, influence strategic decision-making processes at the executive level, and what measures can be implemented to mitigate their impact ?

-

Sing to the Sky is a club that promotes choral singing among teenagers. Every year an outdoor concert with an evening barbecue is given at the clubhouse to raise funds for the club. The following...

-

Why is homeostasis defined as the "relative constancy of the internal environments? Does negative feedback or positive feedback tend to promote homeostasis?

-

Gorky-Park Corporation provides postretirement health care benefits to employees who provide at least 12 years of service and reach age 62 while in service. On January 1, 2018, the following...

-

Southeast Technology provides postretirement health care benefits to employees. On January 1, 2018, the following plan-related data were available: ($ in thousands) Prior service cost-originated in...

-

Frazier Refrigeration amended its defined benefit pension plan on December 31, 2018, to increase retirement benefits earned with each service year. The consulting actuary estimated the prior service...

-

Zafra and Stephanie formed an equal profit- sharing O&S Partnership during the current year, with Zafra contributing $100,000 in cash and Stephanie contributing land (basis of $60,000, fair market...

-

What is the Breakeven Point in units assuming a product selling price is $100, Fixed Costs are $8,000, Variable Costs are $20, and Operating Income is $32,000 ? 100 units 300 units 400 units 500 units

-

Given the following financial data for the Smith Corporation, calculate the length of the firm's operating cycle (OC). Sales $2,610,000 Cost of Good Sold $2,088,000 Inventory $ 278,400 Accounts...

Study smarter with the SolutionInn App