An important difference between U.S. and international accounting standards is the accounting for liabilities related to provisions.

Question:

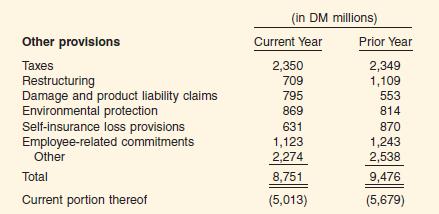

An important difference between U.S. and international accounting standards is the accounting for liabilities related to provisions. Due in part to differences in tax laws, accounting standards in some countries and the standards issued by the International Accounting Standards Board (IASB) allow recognition of liabilities for items that would not meet the definition of a liability under U.S. GAAP. The following note disclosure for liabilities related to provisions was provided by Hoechst A.G., a leading German drug company, in its annual report. Hoechst prepares its statements in accordance with IASB standards.

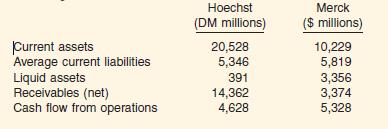

Hoechst reported the following additional items in its annual report. Data for Merck & Co., a U.S. drug company, are provided for comparison.

Instructions

(a) Compute the following ratios for Hoechst and Merck: current ratio, acid-test ratio, and the current cash debt coverage ratio. Compare the liquidity of these two drug companies based on these ratios.

(b) Identify items in Hoechst’s provision disclosure that likely would not be recognized as liabilities under U.S. GAAP. (Hint: Refer to Illustration 13-10 in the chapter.)

(c) Discuss how the items identified in

(b) would affect the comparative analysis in part (a). What adjustments would you make in your analysis? Assume that 75% of the provisions for restructuring and self-insurance are current liabilities

Step by Step Answer:

Intermediate Accounting

ISBN: 9780471448969

11th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield