You have observed the following returns over time: Assume that the risk-free rate is 6% and the

Question:

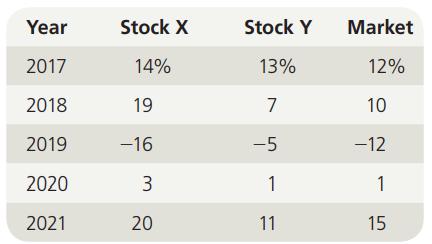

You have observed the following returns over time:

Assume that the risk-free rate is 6% and the market risk premium is 5%.

a. What are the betas of Stocks X and Y?

b. What are the required rates of return on Stocks X and Y?

c. What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Financial Management

ISBN: 9780357516669

14th Edition

Authors: Eugene F Brigham, Phillip R Daves

Question Posted: