1.2. The U.S. government would like to help the American auto industry compete against foreign automakers that...

Question:

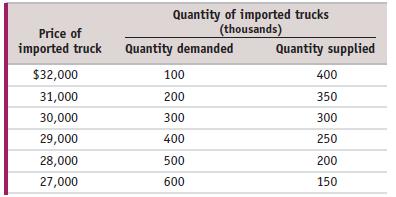

1.2. The U.S. government would like to help the American auto industry compete against foreign automakers that sell trucks in the United States. It can do this by imposing an excise tax on each foreign truck sold in the United States. The hypothetical pre-tax demand and supply schedules for imported trucks are given in the accompanying table.

a. In the absence of government interference, what is the equilibrium price of an imported truck? The equilibrium quantity? Illustrate with a diagram.

b. Assume that the government imposes an excise tax of $3,000 per imported truck. Illustrate the effect of this excise tax in your diagram from part

a. How many imported trucks are now purchased and at what price?

How much does the foreign automaker receive per truck?

c. Calculate the government revenue raised by the excise tax in part

b. Illustrate it on your diagram.

d. How does the excise tax on imported trucks benefit American automakers? Who does it hurt? How does inefficiency arise from this government policy?

Step by Step Answer: