1.1. The United States imposes an excise tax on the sale of domestic airline tickets. Lets assume...

Question:

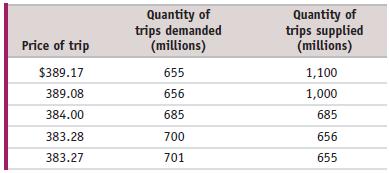

1.1. The United States imposes an excise tax on the sale of domestic airline tickets. Let’s assume that in 2006 the total excise tax was

$5.80 per airline ticket (consisting of the $3.30 flight segment tax plus the $2.50 September 11 fee). According to data from the Bureau of Transportation Statistics, in 2006, 656 million passengers traveled on domestic airline trips at an average price of

$389.08 per trip. The accompanying table shows the supply and demand schedules for airline trips. The quantity demanded at the average price of $389.08 is actual data; the rest is hypothetical.

a. What is the government tax revenue in 2006 from the excise tax?

b. On January 1, 2007, the total excise tax increased to $5.90 per ticket. What is the equilibrium quantity of tickets transacted now? What is the average ticket price now? What is the 2007 government tax revenue?

c. Does this increase in the excise tax increase or decrease government tax revenue?

Step by Step Answer: