13. Omni Advisors, an international pension fund manager, plans to sell equities denominated in Swiss francs (CHF)

Question:

13. Omni Advisors, an international pension fund manager, plans to sell equities denominated in Swiss francs (CHF) and purchase an equivalent amount of equities denominated in South African rands (ZAR).

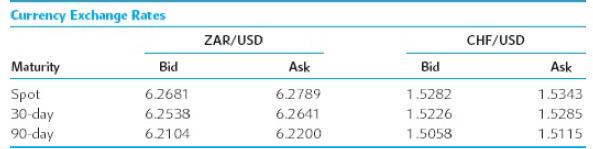

Omni will realize net proceeds of 3 million CHF at the end of 30 days and wants to eliminate the risk that the ZAR will appreciate relative to the CHF during this 30-day period. The following exhibit shows current exchange rates between the ZAR, CHF, and the U.S. dollar (USD).

a. Describe the currency transaction that Omni should undertake to eliminate currency risk over the 30-day period.

b. Calculate the following:

The CHF/ZAR cross-currency rate Omni would use in valuing the Swiss equity portfolio.

The current value of Omni’s Swiss equity portfolio in ZAR.

The annualized forward premium or discount at which the ZAR is trading versus the CHF.

Step by Step Answer:

ISE International Financial Management

ISBN: 9781260575316

9th International Edition

Authors: Cheol Eun, Bruce Resnick, Tuugi Chuluun