On 30 September 2019, K Ltd paid 140,000 to acquire 40% of the ordinary share capital of

Question:

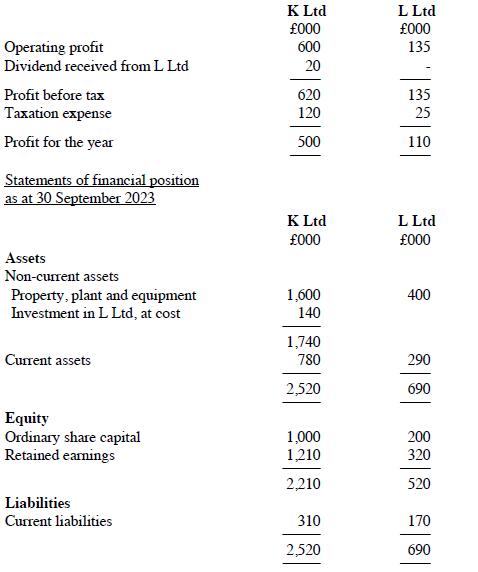

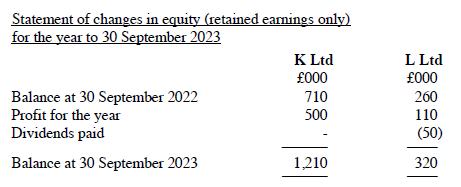

On 30 September 2019, K Ltd paid £140,000 to acquire 40% of the ordinary share capital of L Ltd (which became its associate). Draft financial statements for these two companies for the year to 30 September 2023 are as follows:

Statements of comprehensive income for the year to 30 September 2023

The following information is also available:

(i) In the draft financial statements of K Ltd, the company's investment in L Ltd has been recognised at cost and the dividend received from L Ltd has been recognised as income. These financial statements show the situation as it would be without application of the equity method, either in the year to 30 September 2023 or in previous years.

(ii) The retained earnings of L Ltd on 30 September 2019 were £100,000 and all of its assets and liabilities were carried at fair value. Neither company has issued any shares since that date.

(iii) During the year to 30 September 2023, K Ltd bought goods from L Ltd for £30,000 which had cost L Ltd £20,000. One-quarter of these goods were unsold by K Ltd at 30 September 2023.

Required:

Prepare the financial statements of K Ltd for the year to 30 September 2023.

Step by Step Answer:

International Financial Reporting a practical guide

ISBN: 9781292439426

8th Edition

Authors: Alan Melville