On 1 October 2023 Pumice acquired the following non-current investments: (i) 80% of the equity share capital

Question:

On 1 October 2023 Pumice acquired the following non-current investments:

(i) 80% of the equity share capital of Silverton at a cost of £13. 6 million

(ii) 50% of Silverton's 10% loan notes at par

(iii) 1. 6 million equity shares in Amok at a cost of £6.25 each.

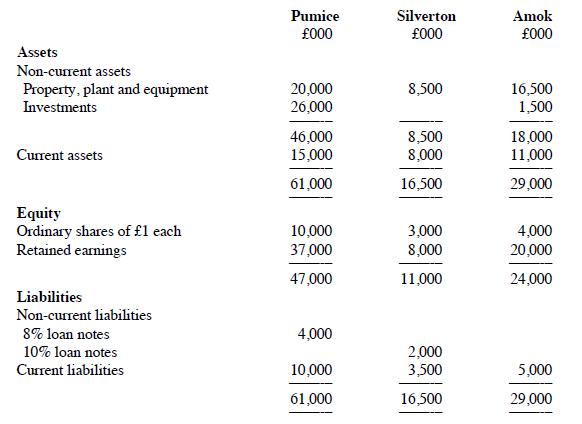

Draft statements of financial position of the three companies at 31 March 2024 are:

The following information is relevant:

(i) On 1 October 2023, the fair values of Silverton's assets were equal to their carrying amounts with the exception of land and plant. Silverton's land had a fair value of £400,000 in excess of its carrying amount and plant had a fair value of £1. 6 million in excess of its carrying amount. The plant had a remaining life of four years (straight-line depreciation) at the date of acquisition.

(ii) In the post-acquisition period, Pumice sold goods to Silverton for £6 million. These goods had cost Pumice £4 million. Half of these goods were still in the inventory of Silverton at 31 March 2024. Silverton had a balance of £1. 5 million owing to Pumice at 31 March 2024 which agreed with Pumice's records.

(iii) The profit after tax for the year ended 31 March 2024 was £2 million for Silverton and £8 million for Amok. Assume profits accrued evenly throughout the year.

(iv) An impairment test at 31 March 2024 concluded that consolidated goodwill was impaired by £400,000 and the investment in Amok was impaired by £200,000.

(v) No dividends were paid during the year by any of the companies.

(vi) Non-controlling interests in subsidiaries are to be measured at the non-controlling shareholders' proportion of the subsidiary's identifiable net assets.

Required:

(a) Explain how the investments purchased by Pumice on 1 October 2023 should be treated in its consolidated financial statements.

(b) Prepare the consolidated statement of financial position for Pumice as at 31 March 2024.

Step by Step Answer:

International Financial Reporting a practical guide

ISBN: 9781292439426

8th Edition

Authors: Alan Melville