Africa offers a fast growing and exciting mobile phone market, with more than 50% growth per year

Question:

Africa offers a fast growing and exciting mobile phone market, with more than 50% growth per year since 2002. More than 28% of African consumers own mobile phones; a larger market than North America. One analyst suggested, “This is a market in the making—as the U.S. was 150 years ago and as China was 20 years ago. If you can get in and if you ride this constantly changing market, there are countless fortunes to be made.”5 Beyond South Africa and possibly Kenya or Uganda, the rest of the African continent is less- or even least-developed economically. Several factors account for the rapid growth in generally poor consumers in these countries.

The village of Dertu in Kenya is far removed from quality roads and infrastructure. The village does not have effective fixed landlines for a telephone service. Instead, the leader of the village, Ibrahim Ali Hassan, describes a mobile phone as his “link with the outside world.” When a local farmer was outside of town as his wife went into labor, a mobile phone call rushed him back to take her to the hospital. The baby was healthy and named after the phone company—Celtel. When a young child was bitten by a snake, a cell phone call helped the victim’s parents identify the correct antidote.

Across Africa outside access to isolated communities is created by mobile phones. Instead of traditional landlines, consumers have moved directly to mobile communication. Ninety percent of phone subscribers in Africa use mobile phones. They often prefer the more accessible pay-as-you-go models, which allow consumers greater flexibility than traditional monthly plans. Payments are linked to usage rates. Consumers keep multiple SIM memory cards, switching to the company providing the best rate for the call being made. Short calls or even flashing—the act of calling and hanging up after one ring so that the person will not be billed for the call—also help keep costs low.

Mobile phones usage in Africa differs from other parts of the world. For many consumers, mobile technology provides a primary source of information.

Mobile phones help track the price of crops and send reminders to take medicines. They save wasted trips outside of the village. Due to this focus on function, many mobile phones typically are stripped down to only provide the ability to call and send text messages.

Mobile banking also drives increased usage. As traditional banks struggle to penetrate many parts of the continent, mobile banking fills the gap. Vodafone used its m-Pesa (pesa is Swahili for money) mobile banking service to expand into Kenya. In two short years, the product went from introduction to 5 million customers. More than 50% of the Kenyan market uses mobile banking for money transfers. While transactions are small, around 1,500 Kenyan shillings ($20), the lower fees than traditional banks have saved poor Kenyans an estimated $4 million per week. Africa offers a potentially rich target market for mobile phone providers.

In some areas, mobile minutes are substitutes for actual money. In Uganda, a villager can transfer money to relatives through the village mobile phone representative. A prepaid card is purchased, which is added to the relative’s account, and then, after a fee has been paid, that amount in cash is transferred to the relative.

The African market appears to have given local companies a first-mover advantage. Outside companies entering the highly competitive market have struggled. There are large barriers to entry in terms of cost and governmental approval. Markets tend to be intensely competitive with three, four, five, or even six local providers. The result has been that a large number of the largest companies are local or are from other developing countries.

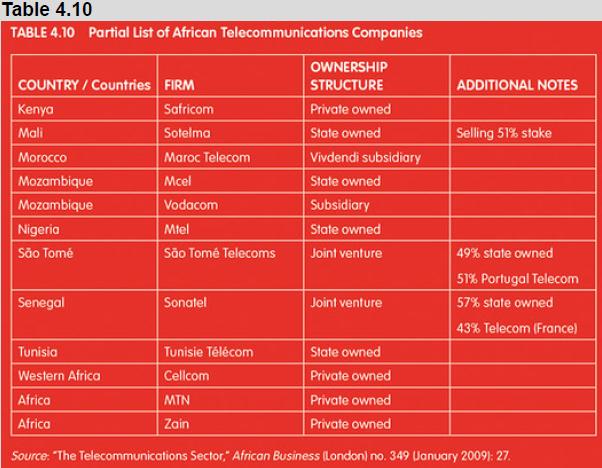

Various types of ownership structures exist in the African telecommunications industry. Table 4.10 summarizes some of the important players. Ownership varies from state-owned industries to joint ventures to subsidiaries.

Questions

1. Discuss the difference between the use of mobile phones in the African cellular phone market compared with cell phone use in developedcountry cellular phone markets.

2. How might the different ownership structures in Africa reflect potential economic systems in the host countries?

3. Would the model for mobile phone expansion apply to other less- or least-developed countries? Why or why not?

4. How do Porter’s five factors explain the high level of industry competitive intensity in the African mobile phone market?

5. How might an African government apply Porter’s national competitive advantage diamond to further spur mobile phone specialization within a country?

Step by Step Answer:

International Marketing

ISBN: 9781506389219

2nd Edition

Authors: Daniel W. Baack, Barbara Czarnecka, Donald E. Baack