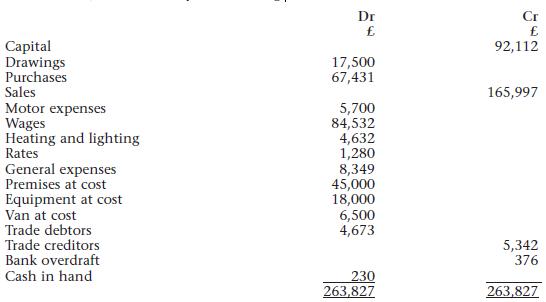

Lottie Chum provides the following trial balance extracted from her books of account on 31 October 20*8,

Question:

Lottie Chum provides the following trial balance extracted from her books of account on 31 October 20*8, after her first year of trading.

Additional information at 31 October 20*8:

stock was valued at £11,096; heating and lighting owing amounted to £329.

Required

Prepare:

a) A trading and profit and loss account for the year ended 31 October 20*8

b) A balance sheet at 31 October 20*8.

Transcribed Image Text:

Capital Drawings Purchases Sales Motor expenses Wages Heating and lighting Rates General expenses Premises at cost Equipment at cost Van at cost Trade debtors Trade creditors Bank overdraft Cash in hand Dr £ 17,500 67,431 5,700 84,532 4,632 1,280 8,349 45,000 18,000 6,500 4,673 230 263,827 Cr £ 92,112 165,997 5,342 376 263,827

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (6 reviews)

Trading and Profit and Loss Account for the Year Ended 31 October 208 Particu...View the full answer

Answered By

Abdul Wahab Qaiser

Before working at Mariakani, I volunteered at a local community center, where I tutored students from diverse backgrounds. I helped them improve their academic performance and develop self-esteem and confidence. I used creative teaching methods, such as role-playing and group discussions, to make the learning experience more engaging and enjoyable.

In addition, I have conducted workshops and training sessions for educators and mental health professionals on various topics related to counseling and psychology. I have presented research papers at conferences and published articles in academic journals.

Overall, I am passionate about sharing my knowledge and helping others achieve their goals. I believe that tutoring is an excellent way to make a positive impact on people's lives, and I am committed to providing high-quality, personalized instruction to my students.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Tonya Gook provides the following trial balance extracted from her books of account on 30 November 20*8: Additional information at 30 November 20*8: stock was valued at 6,236; accrued wages 368;...

-

Julie Wreak provides the following trial balance extracted from her books of account on 31 May 20*8: Additional information at 31 May 20*8: stock was valued at 34,897; wages amounting to 6,238 had...

-

Natasha Bedi provides the following trial balance extracted from her books of account on 31 January 20*8: Additional information at 31 January 20*8: stock was valued at 10,564; rates paid in advance...

-

Given the monthly returns that follow, find the R2, alpha, and beta of the portfolio. Compute the average return differential with and without sign. Do not round intermediate calculations. Round your...

-

For a recent 2-year period, the balance sheet of Metal Pro Company showed the following stockholders equity data at December 31, in millions. Instructions (a) Answer the following questions. (1) What...

-

Prepare the management section of a project proposal dealing with environmental impact assessment for a new industry. Use the same industry type selected in Exercise 2.9.

-

17. Assume r = 8%, = 30%, = 0. Using 1-year-to-expiration European options, construct a position where you sell two 80-strike puts, buy one 95-strike put, buy one 105-strike call, and sell two...

-

Water is flowing from the 150-mm-diameter fire hydrant with a velocity vB = 15 m/s. Determine the horizontal and vertical components of force and the moment developed at the base joint A, if the...

-

6. value: 10.00 points The most recent financial statements for Alexander Co. are shown here: Income Statement Sales $ 38,000 Costs 29,000 Current assets Fixed assets Balance Sheet $ 21,200 Long-term...

-

Toby Moore provides the following trial balance extracted from his books of account on 31 July 20*8. Additional information at 31 July 20*8: stock was valued at 9,315; insurance has been prepaid 58....

-

Ben Trent provides the following trial balance extracted from his books of account on 31 March 20*8, after his first year of trading: Additional information at 31 March 20*8: stock was valued at...

-

Complete the run ticket on p. 341 and give the entry to record the sale of the oil at \($30/bbl\) assuming a severance tax rate of 5% and a 1/5 RI. Use the tables given in the chapter. The tank...

-

Matthew Kennedy of Urbana, Ohio, is single and has been working as an admissions counselor at a university for five years. Matthew owns a home valued at $250,000 on which he owes $135,000. He has a...

-

Question: A group of employees of Unique Services will be surveyed about a new pension plan. In-depth interviews with each employee selected in the sample will be conducted. The employees are...

-

On January 1, 2020, the following accounts appeared in the general ledger of Ace's Repair Shop: Cash P10,500 Accounts receivable 8.400 Furniture 12,600 Repair Equipment 54,000 Accounts Payable 22,000...

-

Your maths problem x+3x-3 Find solutions on the web Q +1 XII

-

5. Data for the payroll for the Dos Company for the month of April are shown below: Total gross earnings Social security taxes withheld Phil Health taxes withheld Employees income tax withheld...

-

What are some of the ways companies can continue to motivate their employees in a time of a recession and extended higher unemployment.

-

(a) Water flows through the nozzle of a garden hose. Find an expression for m in terms of line pressure P 1 , ambient pressure P 2 , inside hose diameter D 1 , and nozzle outlet diameter D 2 . Assume...

-

Osprey Corporation, a closely held corporation, has $100,000 of net active income, $25,000 of portfolio income, and a $120,000 loss from a passive activity. a. How much of the passive loss can Osprey...

-

Marmot Corporation pays a dividend of $100,000 in the current year. Otter Corporation, which is in the 25% marginal bracket, owns 15% of Marmots stock. Gerald, an individual taxpayer in the 25%...

-

Barbara owns 40% of the stock of Cassowary Corporation (a C corporation) and 40% of the stock of Emu Corporation (an S corporation). In the current year, each corporation has operating income of...

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App