Below are financial statements for Eastnorth Manufacturing. After computing the ratios we discussed in this chapter, discuss

Question:

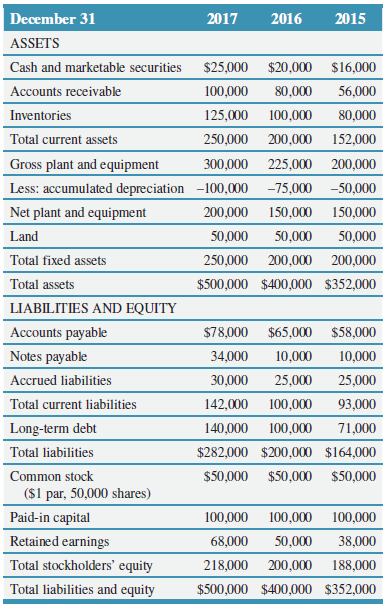

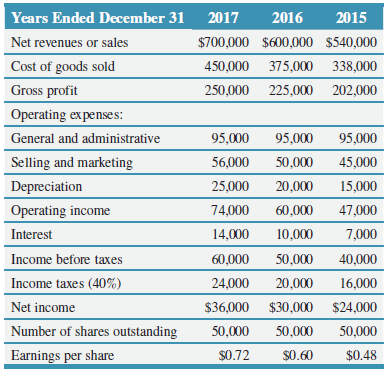

Below are financial statements for Eastnorth Manufacturing. After computing the ratios we discussed in this chapter, discuss strong and weak points of Eastnorth’s performance.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

December 31 2017 2016 2015 ASSETS Cash and marketable securities $25,000 $20,000 $16,000 80,000 Accounts receivable 100,000 56,000 Inventories 125,000 100,000 80,000 Total current assets 250,000 200,000 152,000 Gross plant and equipment 300,000 225,000 200,000 Less: accumulated depreciation -100,000 -75,000 –50,000 Net plant and equipment 200,000 150,000 150,000 50,000 Land 50,000 50,000 Total fixed assets 250,000 200,000 200,000 Total assets $500,000 $400,000 $352,000 LIABILITIES AND EQUITY Accounts payable $78,000 $65,000 $58,000 Notes payable 10,000 10,000 34,000 25,000 25,000 Accrued liabilities 30,000 Total current liabilities 93,000 142,000 100,000 Long-term debt 140,000 100,000 71,000 Total liabilities $282,000 $200,000 $164,000 Common stock $50,000 $50,000 $50,000 ($1 par, 50,000 shares) 100,000 100,000 100,000 Paid-in capital 50,000 Retained earnings 68,000 38,000 Total stockholders' equity 218,000 200,000 188,000 Total liabilities and equity $500,000 $400,000 $352,000 Years Ended December 31 2017 2016 2015 Net revenues or sales $700,000 $600,000 $540,000 Cost of goods sold 450,000 375,000 338,000 Gross profit 250,000 225,000 202,000 Operating expenses: General and administrative 95,000 95,000 95,000 Selling and marketing 56,000 50,000 45,000 Depreciation 25,000 20,000 15,000 Operating income 74,000 60,000 47,000 Interest 14,000 10,000 7,000 Income before taxes 60,000 50,000 40,000 Income taxes (40%) 24,000 20,000 16,000 Net income $36,000 $30,000 $24,000 Number of shares outstanding 50,000 50,000 50,000 Earnings per share $0.72 $0.60 $0.48

Step by Step Answer:

Ratio 2017 2016 2015 Current ratio 18 20 163 Quick ratio 09 10 077 Average payment perio...View the full answer

Introduction to Finance Markets, Investments and Financial Management

ISBN: 978-1119398288

16th edition

Authors: Ronald W. Melicher, Edgar A. Norton

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Using the financial statements below, a. Compute common-size financial statements. b. Put together a statement of cash flows of the firm. Where did the firm invest funds during the year? How did it...

-

Listed below are financial statements for the Sunflower Company. Income Statement For the Year Ended December 31, 2004 Sales revenue ............$ 20,000 Cost of sales .............. (12,000) Gross...

-

Below are financial statements for Sentec Inc., a distributor of electrical fixtures, for 2008, 2009, and 2010. a. Compute Sentec Inc.s working capital requirement (WCR) on December 31, 2008, 2009,...

-

For the beam illustrated in the figure, find the locations and magnitudes of the maximum tensile bending stress due to M and the maximum shear stress due toV. 4500 N 20 mm 300 mm 150 mm 40 mm

-

Verify that interchanging rows p and q (q > p) can be accomplished using 2(q - p) - 1 adjacent interchanges.

-

Use a calculator to solve the given equation. 5 x+ 2 = 3e 2x

-

Discuss methods for controlling communications to ensure that information needs are met throughout the life of the project? LO.1

-

Zocco Corporation has an inventory conversion period of 75 days, an average collection period of 38 days, and a payables deferral period of 30 days. a. What is the length of the cash conversion cycle...

-

Identify the three kinds of symptoms that can result from negative stress and provide examples of each

-

EVA Company was incorporated on January 2, Year 5, and commenced active operations immediately. Ordinary shares were issued on the date of incorporation and no new ordinary shares have been issued...

-

Genatron wants to estimate what will happen to its income before interest and taxes if its net sales change from the 2017 level of $1,500,000. Refer to Genatrons 2017 income statement, shown in...

-

Following are the consolidated financial statements for Eastnorth Manufacturings industry. Use DuPont analysis on the industry financial statements to determine why industry return on equity (ROE)...

-

John is a teacher at a local high school. During 2016, he travels three days per week to a school in the next county to work with gifted children in an after-school program that does not end until...

-

What strategies can organizations employ to effectively manage workforce diversity and foster inclusion to leverage the full potential of their human capital in a globalized marketplace ?

-

You are given an array of integers representing the prices of a stock on different days. Write a function in JavaScript to calculate the maximum profit that can be obtained by buying and selling the...

-

The following selected information is available for the payroll computations of a company for the month of November 2021: Name of the Employee Gross Payroll for the month Elvira Robles Gloria...

-

Enter the code (from the Code tab) into your compiler. Compile your code and run it. Answer the following critical thinking questions. Save your answers in a Word document. What happens if you enter...

-

How would applying the core values and concepts of the Baldrige Performance Excellence Framework improve healthcare quality?

-

In Exercises evaluate the expression sin-1(15)) 13 tan sin

-

Ex. (17): the vector field F = x i-zj + yz k is defined over the volume of the cuboid given by 0x a,0 y b, 0zc, enclosing the surface S. Evaluate the surface integral ff, F. ds?

-

In your own words, explain how buying behavior of business customers in different countries may have been a factor in speeding the spread of international marketing.

-

Compare and contrast the buying behavior of final consumers and organizational buyers. In what ways are they most similar and in what ways are they most different?

-

Briefly discuss why a marketing manager should think about who is likely to be involved in the buying center for a particular purchase. Is the buying center idea useful in consumer buying? Explain...

-

During the year 2021, William has a job as an accountant, he earns a salary of $100,000. He has done some cleaning services work on his own (self-employed), where he earned a net income of $50,000....

-

Fixed cost per unit is $7 when 25,000 units are produced and $5 when 35,000 units are produced. What is the total fixed cost when 30,000 units are produced? Group of answer choices $150,000....

-

Revenue Recognition and Sales Allowances accounting purposes ) . The goods are shipped from the warehouse on March 6 , and FedEx confirms delivery on March 7 . Ignore shipping costs, sales tax, and...

Study smarter with the SolutionInn App