Black-Scholes PDE with dividends. Consider a riskless asset with price (A_{t}=) (A_{0} mathrm{e}^{r t}, t geqslant 0),

Question:

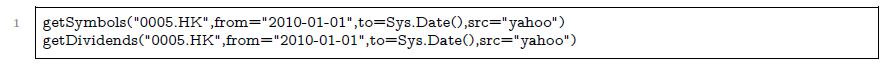

Black-Scholes PDE with dividends. Consider a riskless asset with price \(A_{t}=\) \(A_{0} \mathrm{e}^{r t}, t \geqslant 0\), and an underlying asset price process \(\left(S_{t}ight)_{t \in \mathbb{R}_{+}}\)modeled as

\[ d S_{t}=(\mu-\delta) S_{t} d t+\sigma S_{t} d B_{t} \]

where \(\left(B_{t}ight)_{t \in \mathbb{R}_{+}}\)is a standard Brownian motion and \(\delta>0\) is a continuous-time dividend rate. By absence of arbitrage, the payment of a dividend entails a drop in the stock price by the same amount occurring generally on the ex-dividend date, on which the purchase of the security no longer entitles the investor to the dividend amount. The list of investors entitled to dividend payment is consolidated on the date of record, and payment is made on the payable date.

a) Assuming that the portfolio with value \(V_{t}=\xi_{t} S_{t}+\eta_{t} A_{t}\) at time \(t\) is self-financing and that dividends are continuously reinvested, write down the portfolio variation \(d V_{t}\).

b) Assuming that the portfolio value \(V_{t}\) takes the form \(V_{t}=g\left(t, S_{t}ight)\) at time \(t\), derive the Black-Scholes PDE for the function \(g(t, x)\) with its terminal condition.

c) Compute the price at time \(t \in[0, T]\) of the European call option with strike price \(K\) by solving the corresponding Black-Scholes PDE.

d) Compute the Delta of the option.

Step by Step Answer:

Introduction To Stochastic Finance With Market Examples

ISBN: 9781032288277

2nd Edition

Authors: Nicolas Privault